The Role that Class I Common Shares Play in Nontraded REIT Capital Raise

December 22, 2021 | James Sprow | Blue Vault

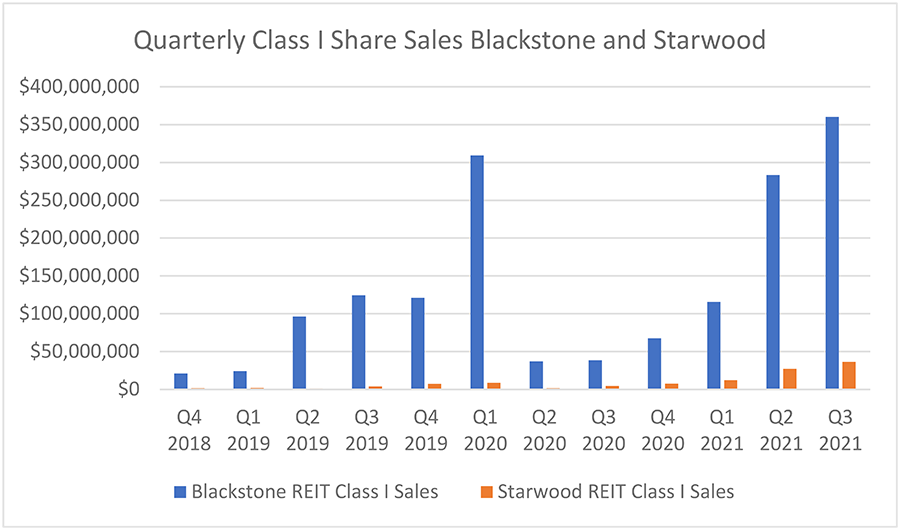

Blackstone Real Estate Income Trust (“BREIT”) came into the nontraded REIT space with a bang, raising more capital than all other programs combined, and doing so by issuing Class I common shares with a $1,000,000 minimum investment. Other continuously-offered nontraded REIT programs have followed that model, issuing more and more Class I common shares with the same $1,000,000 minimum investment. Blackstone REIT and Starwood REIT have together issued over $1.8 billion shares of Class I stock. During the period August 2018 through December 2019 when Blackstone REIT was reporting monthly sales to Blue Vault, the share of total sales that were from Class I shares rose from 84% to 98%. This means that Blackstone REIT is raising a large majority of its capital from Class I shares issued to high net worth or ultra high net worth investors or institutional investors.

The language in the Blackstone REIT Prospectus defines the Class I shares:

Class I Shares

No upfront selling commissions or stockholder servicing fees are paid for sales of any Class I shares.

Class I shares are generally available for purchase in this offering only (1) through fee-based programs, also known as wrap accounts, that provide access to Class I shares, (2) by endowments, foundations, pension funds and other institutional investors, (3) through participating broker-dealers that have alternative fee arrangements with their clients to provide access to Class I shares, (4) through certain registered investment advisers, (5) by our executive officers and directors and their immediate family members, as well as officers and employees of the Adviser, Blackstone or other affiliates and their immediate family members, and joint venture partners, consultants and other service providers or (6) other categories of investors that we name in an amendment or supplement to this prospectus. In certain cases, where a holder of Class S, Class T or Class D shares exits a relationship with a participating broker-dealer for this offering and does not enter into a new relationship with a participating broker-dealer for this offering, such holder’s shares may be exchanged into an equivalent NAV amount of Class I shares.

The minimum initial investment for Class I shares is $1,000,000, unless waived by the Dealer Manager. If you are eligible to purchase all four classes of shares, you should consider, among other things, the amount of your investment, the length of time you intend to hold the shares and the upfront selling commissions, dealer manager fees and stockholder servicing fees attributable to the Class T, Class S or Class D shares.

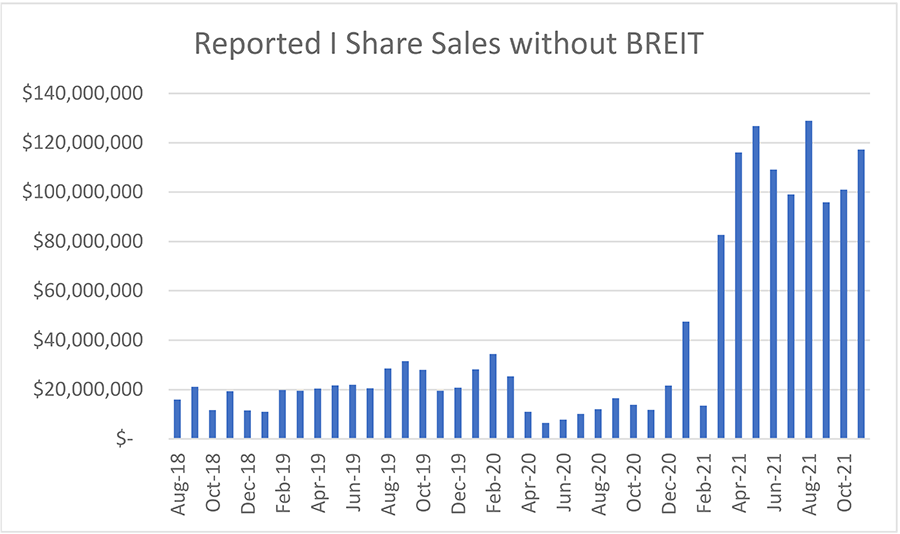

The trend toward raising capital with Class I shares is evident in the sales of the other continuous offerings that report monthly sales to Blue Vault. In the following chart it is clear that beginning in 2021, the sales of Class I shares have exploded:

The Class I share language in the other open nontraded REIT prospectuses is virtually identical to that in the BREIT prospectus. All have the same $1,000,000 minimums for Class I share sales.

The quarterly sales of Class I shares by BREIT and Starwood REIT can be found in their quarterly SEC filings. The impact of the pandemic on sales is evident, but 2021 will be a huge record year for nontraded REIT capital raise, the large majority of sales coming from Class I common stock.

Sources: SEC, Blue Vault