Recent Total Returns to Continuously Offered Nontraded REITs

March 8, 2021 | James Sprow | Blue Vault

Most nontraded REITs with continuous offerings have reported their total returns for January 2021. For the ten nontraded REITs that have reported total returns for January 2021, the median total return was 0.67%, which includes distributions and changes in per share net asset values (NAVs). Nuveen Global Cities REIT, Inc. led the REITs that have reported their total returns for January 2021, posting a total return of 1.53% for their Class I shares. Next was Blackstone Real Estate Income Trust’s total return to Class I shares at 1.42%. For the year 2020 Blackstone’s Class I shares had a total return of 6.92%. Oaktree Real Estate Income Trust led all 14 continuously offered NTRs with a total return for 2020 of 9.95% to Class I shares. Table I shows the median monthly returns for all continuous offering NTRs.

Table I

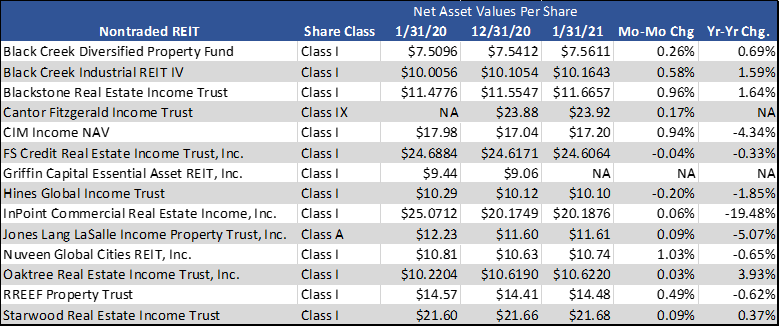

We can also report the changes in net asset values per share for all but two of the continuous offerings. We focus on Class I shares for all but two REITs. The median change in net asset values per share for the 12 months ended January 2021 was a negative 0.47%. The maximum change over the 12-month period was posted by Oaktree Real Estate Income Trust at 3.93%, followed by Blackstone Real Estate Income Trust at 1.64%. Table II shows those changes.

Table II

Sources: SEC, Individual REIT Websites