Recent Secondary Auction Trading of Nontraded REIT Shares

February 22, 2019 | James Sprow | Blue Vault

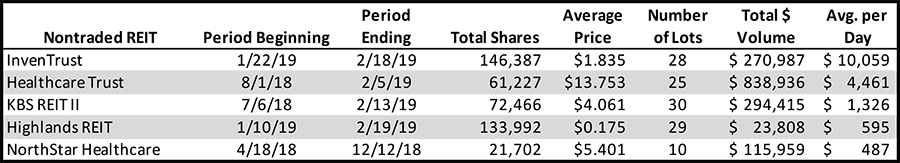

Central Trade & Transfer is an auction site that conducts regular auctions for illiquid shares of all public nontraded REITS and publicly registered limited partnerships. At their website at www.cttauctions.com, data is available for the history of completed auctions for nontraded REIT shares. A listing of some of the more actively auctioned nontraded REITs is shown below.

In this listing, the most auction activity is for the shares of InvenTrust Properties. In terms of average daily dollar volume, this REIT has by far the most dollar volume of shares auctioned over the most recent period, averaging over $10,000 per calendar day in late January and thru February 18, 2019. Highlands REIT, spun off from InvenTrust in April 2016, had the second highest number of total shares auctioned over roughly the same period of time, but the dollar volume was relatively small given the low average price per share.

The prices actually received by shareholders who auctioned their nontraded REIT shares on the auction site would be less than the settlement price, since the auction platform charges a commission to both buyers and sellers of shares.

The difference between the auction prices received by sellers and the latest net asset values per share announced by the REITs can be substantial. For example, InvenTrust announced an estimated NAV per share as of May 1, 2018, of $3.14. Highlands REIT’s most recent estimated NAV per share was $0.33, announced in January 2019. KBS REIT had an estimated net asset value per share of $4.95, as of September 30, 2018. Healthcare Trust’s most recent NAV per share was $20.25 as of December 31, 2017. On February 1, 2019, NorthStar Healthcare Income suspended monthly distributions to stockholders. Its most recent announced estimated NAV per share was $7.10 as of June 30, 2018.

The auction price discounts from the most recently announced net asset values per share ranged from 47% to 18% for this sample, before trading fees.

Sources: cttauctions.com, SEC, Blue Vault