QOFs Tracked by Novogradac Continue on Pace for $10 Billion Year

October 18, 2022 | Michael Novogradac | Novogradac

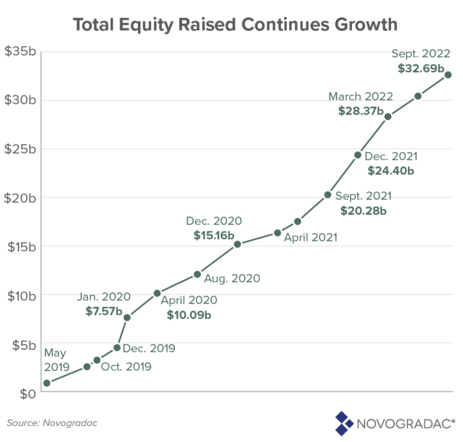

Qualified opportunity funds (QOFs) tracked by Novogradac reported a jump of $2.20 billion in equity raised during the third quarter of 2022, keeping the QOFs on the Novogradac list on pace to surpass a $10 billion single-year increase in equity for the first time since Novogradac began tracking the data.

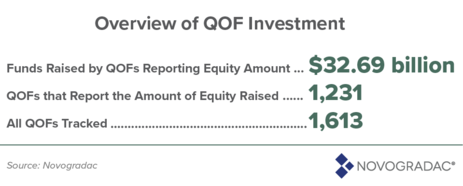

An aggregate amount of $32.69 billion was reported raised as of Sept. 30 by 1,231 QOFs on Novogradac’s tracking list. Novogradac is tracking an additional 382 QOFs for which the amount of equity raised has not been reported. The $32.69 billion raised as of Sept. 30 compares to $30.49 billion at the end of June and $24.40 billion at the end of 2021. The $8.29 billion increase over the first nine months puts the QOFs on the Novogradac list on the verge of breaking 2021’s record of a $9.24 billion increase and going well beyond $10 billion.

While the equity reported increased 7.2% during the third quarter of 2022, the number of QOFs tracked by Novogradac grew by 9.4% and the number of QOFs reporting an equity raise amount increased by 12.2%.

Total investment in QOFs is likely three to four times greater than the $32.69 billion reported by Novogradac because Novogradac’s rolling collection of information comes from QOFs voluntarily providing information or from other public sources such as Securities and Exchange Commission filings and press releases. While the Novogradac list includes single- and multi-asset funds, it does not include proprietary or private funds that are owned and managed by their principal investors.

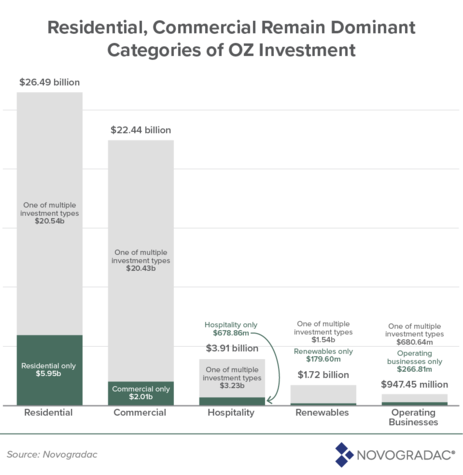

Among the QOFs tracked by Novogradac, residential and commercial investment continue to dominate the types of investment, with each reporting more than $20 billion in investment. (The sum of all types of investment greatly exceeds the $32.69 billion total due to the number of QOFs that invest in multiple areas). QOFs that focus exclusively on residential development report an equity raise of $5.9 billion, easily the highest total raised by QOFs targeting only one of the five areas identified by Novogradac (residential, commercial, hospitality, renewables, operating businesses). Commercial-only-focused QOFs have raised $2.00 billion, while those focused strictly on hospitality, renewable energy and operating businesses each have raised less than $700 million.

Most QOF investment (69.3% of all equity, 83.4% of all QOFs that report a specific equity raise and a geographic target) has been raised by funds that target one or multiple specific cities. The largest QOFs in Novogradac’s survey–those that have raised $100 million or more in equity–have raised 61.0% of all reported equity, although they make up just 5.3% of the number of QOFs that have raised equity. That’s the highest percentage yet for jumbo funds’ portion of overall equity raised. Taken further, 0.7% of QOFs have raised $500 million or more, but that tiny minority has raised 24.6% of all equity. Meanwhile, the smallest QOFs–those that have raised less than $10 million–make up 65.0% of all QOFS and have raised just 6.6% of equity.

The information contained in this blog post is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities. Novogradac does not provide investment advice and the information in this report is not to be construed as a recommendation to engage in any specific transaction. Readers are urged to consult with their own professional advisors if they are considering investing in a QOF.