James Sprow | Blue Vault |

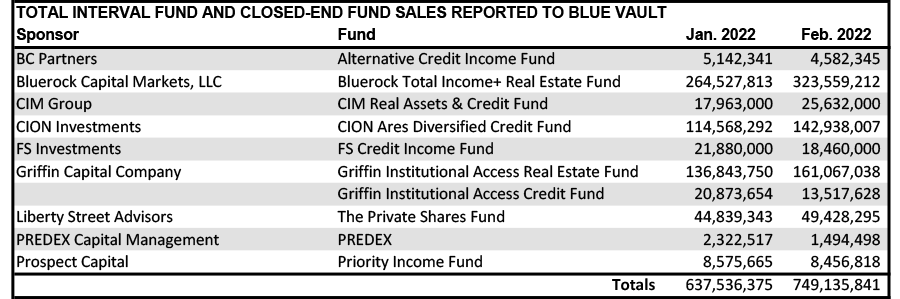

Nine Interval Fund managers and one nontraded Closed-End Fund reported capital raise numbers for February 2022, showing an increase of 17.5% from the capital raised in January 2022 by the same funds. The ten funds raised a total of $749.1 million in February, up from $637.5 million in January. Bluerock Capital Markets had Bluerock Total Income+ Real Estate Fund’s capital raise increase by 22.3%, with $323.6 million in February after raising $264.5 million in January. Griffin Capital’s Griffin Institutional Access Real Estate Fund increased their capital raise by 17.7%, in second place within the sample with $161.1 million in capital raise after raising $136.8 million in January. CION Investments raised $142.9 million for CION Ares Diversified Credit Fund, up 24.8% from the January total of $114.6 million. Another notable increase was seen by The Private Shares Fund managed by Liberty Street Advisors, with $49.4 million in February sales, up 10.2% from the January total of $44.8 million.

In February 2021, these same ten funds raised a total of just $226.8 million. This represents a Y-O-Y increase of 230%. Bluerock Total Income+ Real Estate Fund increased capital raise by $276.5 million from February 2021 to February 2022. CIM Real Estate Assets & Credit Fund had the greatest percentage increase Y-O-Y with a jump of 614% from $3.6 million in February 2021 to $25.6 million in February 2022.

Source: Blue Vault