Phillips Edison & Co. Inc. Files IPO for 17 Million Common Shares

July 12, 2021 | James Sprow | Blue Vault

Phillips Edison & Company filed for an offering of 17.0 million common shares at an expected price between $28.00 and $31.00 per share (or $9.33 and $10.33 per share, as adjusted for the 1-for-3 reverse stock split implemented July 2). The Company expects its common stock to be approved for listing, subject to notice of issuance, on the Nasdaq Global Select Market, or Nasdaq, under the ticker symbol “PECO.” Currently, the Company’s common stock is not traded on a national securities exchange, and this will be its first listed public offering.

Phillips Edison & Company filed for an offering of 17.0 million common shares at an expected price between $28.00 and $31.00 per share (or $9.33 and $10.33 per share, as adjusted for the 1-for-3 reverse stock split implemented July 2). The Company expects its common stock to be approved for listing, subject to notice of issuance, on the Nasdaq Global Select Market, or Nasdaq, under the ticker symbol “PECO.” Currently, the Company’s common stock is not traded on a national securities exchange, and this will be its first listed public offering.

The internally managed real estate investment trust plans to grant the underwriters a 30-day option to buy up to an additional 2,550,000 common shares. Net proceeds from the offering will be used to pay off the REIT’s $375.0 million unsecured term loan, to fund external growth with property acquisitions and for other general corporate uses.

Company Overview

Phillips Edison is one of the nation’s largest owners and operators of omni-channel grocery-anchored shopping centers and has the highest percentage of its properties anchored by top grocers among its public peers, according to JLL. Grocery-anchored neighborhood shopping centers have been its primary focus since it started in business in 1991, and the Company believes this focus has generated superior growth and attractive risk-adjusted returns over time. The REIT’s portfolio primarily consists of neighborhood centers anchored by the #1 or #2 grocer tenants by sales within their respective formats by trade area. As of March 31, 2021, the Company’s portfolio was 94.8% occupied. Its tenants, who the Company refers to as “Neighbors,” are a mix of national, regional, and local retailers that primarily provide necessity-based goods and services.

As of March 31, 2021, the REIT owned equity interests in 300 shopping centers, including 278 wholly-owned properties which contributed more than 98% of its ABR, and 22 shopping center properties owned through two unconsolidated third-party institutional joint ventures. In total, its portfolio of wholly-owned shopping centers and its prorated portion of shopping centers owned through its unconsolidated institutional joint ventures comprises approximately 31.7 million square feet in 31 states.

Phillips Edison & Co.’s business model is founded on owning and operating omni-channel grocery-anchored neighborhood shopping centers that provide necessity-based goods and services to the average American household. As of March 31, 2021, for its wholly-owned shopping centers and its prorated portion of shopping centers owned through unconsolidated joint ventures, approximately 72.6% of ABR comes from necessity-based goods and services retailers. As of March 31, 2021, the wholly-owned centers averaged approximately 113,000 square feet in size, and the average inline Neighbor occupied 2,100 square feet. Its average center, at 113,000 square feet in size, is smaller than those of our public peers, at 217,000 square feet, according to JLL. The Company believes that smaller shopping centers and smaller Neighbor spaces create a positive leasing dynamic as spaces are sized to meet demand from the large variety of retailers that are growing and opening new stores, which the Company believes creates pricing power. In 2019, 65% of leasing activity in strip shopping centers was in spaces of less than 2,500 square feet.

The Company believes its grocery focus is ecommerce resilient and adaptive, with many customers visiting its Neighbors to collect online purchases. It believes that grocery sales are ecommerce resilient because the economics of delivery typically remain unattractive to grocers. The Company believes grocery margins are typically 2-4% and the additional costs associated with delivery produce an overall loss for the grocer unless the customer is willing to pay for the cost of delivery. It believes delivery fees are a major deterrent for customers in the REIT’s markets and that customers have demonstrated a preference for buy-online-pickup-in-store, or BOPIS, over delivery and therefore the store remains the delivery point.

Its filing states that the Company believes that its centers are a critical component of its Neighbors’ omni-channel strategies and that, as ecommerce continues to grow, its centers provide omni-channel retailers with a solution for critical last mile delivery and BOPIS options. As of March 31, 2021, the REIT estimates that 87% of its grocers offer BOPIS options to customers. In 2020, it established Front Row To Go®, a program that provides convenient curbside pick-up and clearly marked parking spaces to facilitate customer pickup from all Neighbors. Approximately 91% of its portfolio now provides Front Row To Go®. The Company believes this program complements its grocers’ expansion of BOPIS and brings consistently high levels of foot traffic to its centers. Its centers now record foot traffic that exceeds levels prior to the onset of the COVID-19 pandemic. During March 2021, foot traffic at it centers was 104% of average monthly levels during 2019 according to data provided by Placer.ai, a company that analyzes location and foot traffic for retailers, commercial real estate owners and municipalities by collecting geolocation and proximity data.

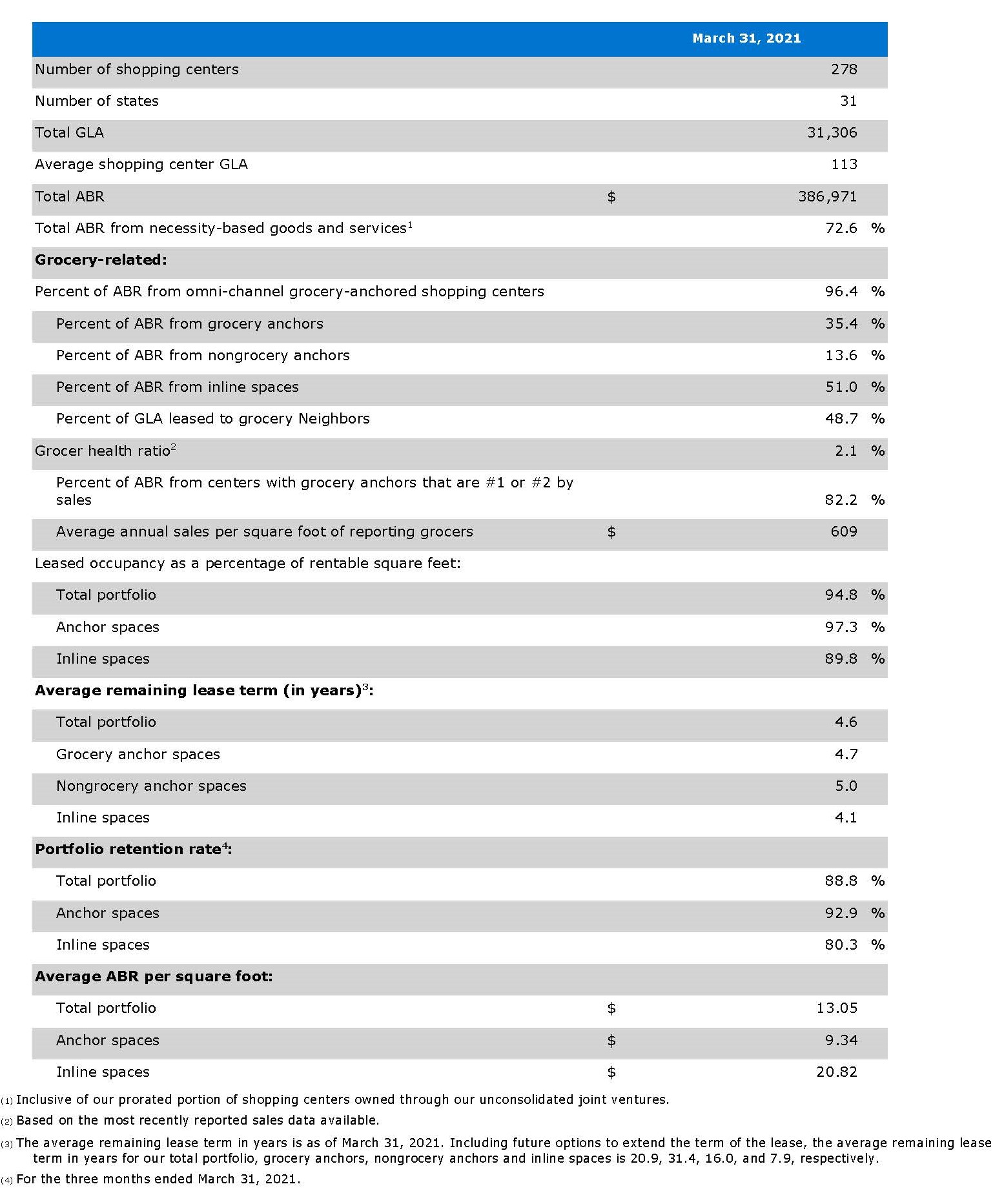

The following table provides summary information regarding the Company’s wholly-owned portfolio (unless otherwise noted) as of March 31, 2021 (dollars and square feet in thousands, excluding per square foot data):

Recent Developments – Operational Update on Leasing

For our wholly-owned properties, as of June 30, 2021, our portfolio’s leased occupancy as a percentage of rentable square feet was 94.7%, compared to 94.8% as of March 31, 2021. Leased occupancy for our anchor spaces was 96.8% as of June 30, 2021, compared to 97.3% as of March 31, 2021, and inline leased occupancy was 90.6% at June 30, 2021 as compared to 89.8% at March 31, 2021. Additionally, average ABR per square foot was $13.21 for our wholly-owned portfolio as of June 30, 2021, including $9.41 in ABR per square foot for our anchor spaces and $21.10 in ABR per square foot for our inline spaces. This compares to $13.05 per square foot for the total portfolio, $9.34 per square foot for anchor spaces, and $20.82 per square foot for inline spaces, all as of March 31, 2021.

Morgan Stanley, BofA Securities, J.P. Morgan, BMO Capital Markets, Goldman Sachs & Co. LLC, KeyBanc Capital Markets, Mizuho Securities and Wells Fargo Securities are joint bookrunning managers for the IPO. BTIG, Capital One Securities, Fifth Third Securities, PNC Capital Markets LLC and Regions Securities LLC are co-managers.

Source: SEC