Owl Rock’s Public BDC Succeeds by Giving Investors Lower Fees and Quality Credit Portfolio (Part 2 of 3)

October 17, 2018 | James Sprow | Blue Vault

During a time when BDCs have been on a downward trend, Owl Rock Capital Partners has found a way to evolve the BDC structure to meet needs across its investor base. By lowering upfront loads, having trailing fees paid by the advisor, better aligning management and shareholder interests, and prioritizing long-run performance rather than the short-term rewards tied to capital raise, Owl Rock Capital Corporation II (“ORCC II”), a nontraded private credit BDC, has an excellent chance of overcoming the perceptions or stereotypes left by legacy nontraded BDCs. It also offers individual investors access to investment opportunities typically only available to larger institutional investors.

Owl Rock was granted exemptive relief to co-invest in March of 2017, making it possible for Owl Rock to place the loans it originates into its institutional private fund, Owl Rock Capital Corporation (“ORCC”) as well as ORCC II. As a result, individual investors in ORCC II have similar credit and risk exposures as the institutional, private ORCC investment. A view into both ORCC and ORCC II’s portfolios as of June 30, 2018 as well as information about Owl Rock’s latest BDC offering are provided below.

Owl Rock Capital Corporation

Back in 2016, ORCC began investing the capital it was raising in its private offering to accredited investors. By June 30, 2018 the BDC had $5.5 billion in total capital commitments from its investors, of which $2.0 billion had been drawn down and a loan portfolio with a fair value of $3.5 billion consisting of predominately first-lien and second-lien secured debt investments to a diversified portfolio of 51 middle-market companies. Approximately 100% of those debt investments were at floating rates, with interest rate floors, protecting potential returns from the impacts of rising interest rates.

As seen below, as of June 30, 2018, ORCC has diversified its lending across more than 25 industries. No single industry has more than 12% of the BDC’s outstanding loans. This diversification protects the company from both cyclical and sector-specific downturns.

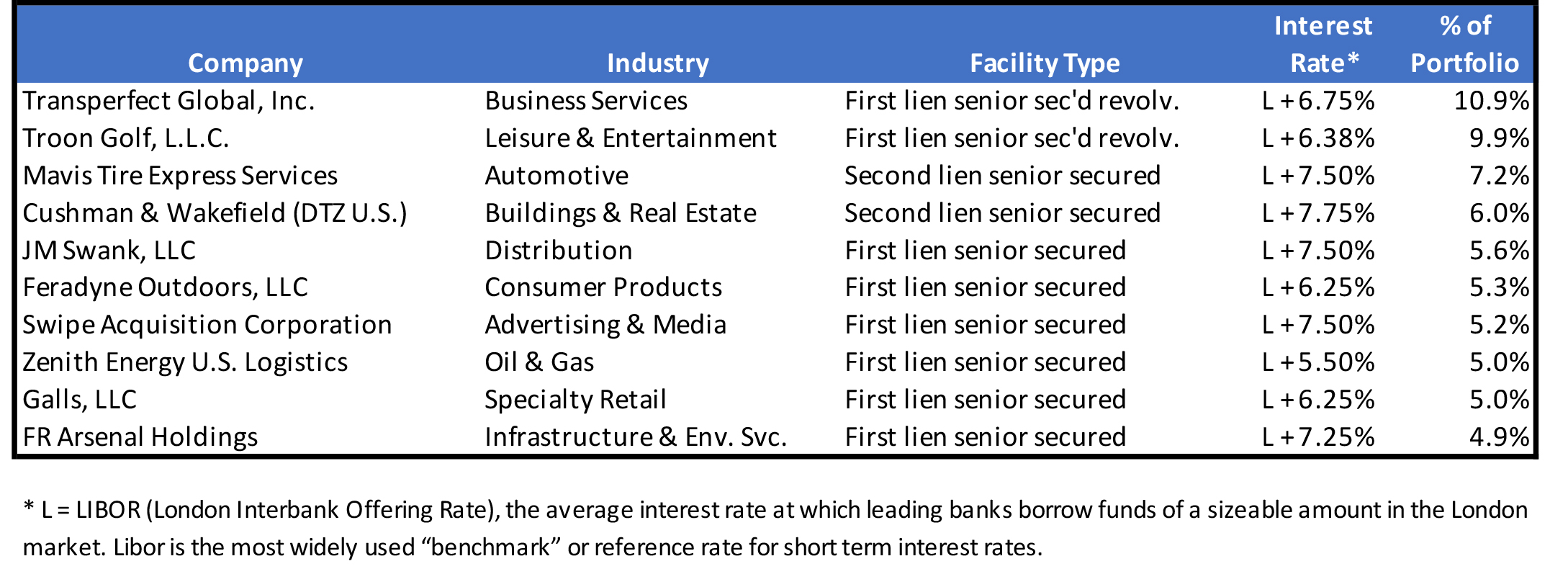

ORCC Largest Portfolio Holdings by Company

Owl Rock Capital Corporation II

In September 2016, Owl Rock filed a registration for a public BDC offering. ORCC II is conducting a best-efforts offering of up 264 million shares. The SEC declared the offering effective on February 3, 2017.

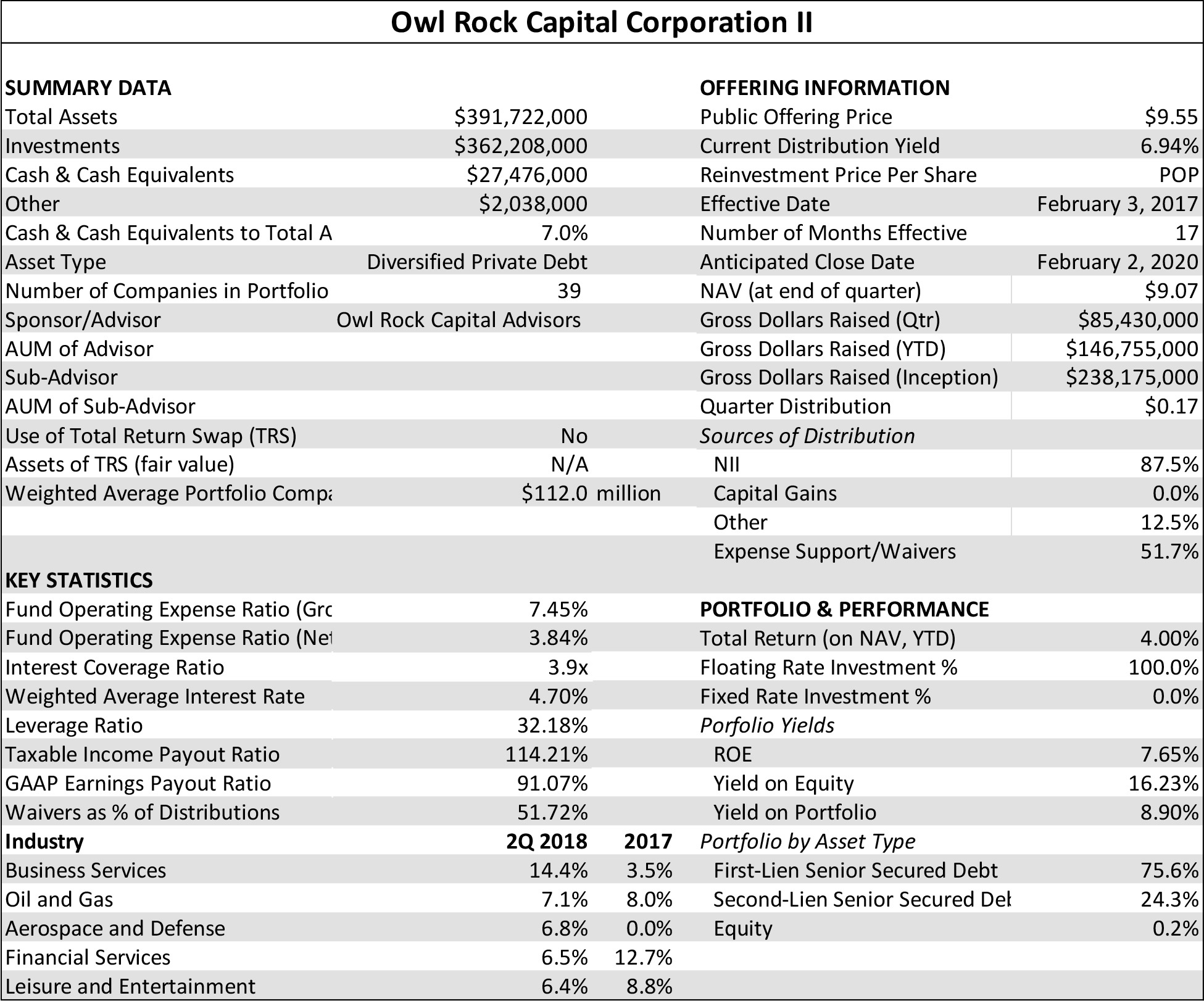

ORCC II began operations in April 2017 and, as of June 30, 2018, had an investment portfolio with a fair value of $362.2 million. The loans in its portfolio have been made to 39 different companies. All of its investments carried variable rates of interest, with a weighted average spread over LIBOR of all of its investments at 6.4%. The weighted average yield on its portfolio was 9.0% as of June 30, 2018. On the other side of the balance sheet, the BDC was using $126.1 million in debt financing, leveraging its assets by borrowing at an average 4.8% interest rate.

Following is key data from Blue Vault’s June 30, 2018, report on ORCC II.

As of June 30, 2018, the annualized shareholder returns for investors in ORCC II was 8.1% without sales charge, and the cumulative total return since inception with maximum sales charge was 4.7%.

ORCC II Largest Portfolio Holdings by Company

As can be seen in the following table, as of June 30, 2018, ORCC II has a significant portion of its portfolio of credits placed with the same companies that appear in ORCC’s portfolio, underscoring Owl Rock’s efforts to align interest among its individual and institutional investors.

Owl Rock’s Latest BDC Offering

Owl Rock’s latest BDC offering, Owl Rock Technology Finance Corp. (“ORTF”), plans to invest in a broad range of established and high growth technology and life sciences-related companies that are capitalizing on the large and growing demand for technology products and services, according to the prospectus filed on August 10, 2018. As in the case of its predecessor, ORCC, ORTF expects to conduct a private offering. It will require investors to fund drawdowns to purchase shares of common stock up to the amount of their respective capital commitments on an as-needed basis to fund loan origination and investment activities. It anticipates commencing its loan origination and investment activities as soon as practicable following the initial drawdowns from investors in the private offering.

ORTF’s adviser will be paid a fee for its services under the Investment Advisory Agreement consisting of two components. A Management Fee will be payable at the annual rate of 0.90% of average gross assets, excluding cash and cash equivalents, at the end of the two most recently completed calendar quarters. A second fee, an Incentive Fee, will consist of two components that are independent of each other. A portion is based on income and a portion is based on capital gains, with rates determined by excesses of investment income beyond certain “hurdle rates” and a percentage of cumulative realized capital gains net of cumulative capital losses, payable at the end of each calendar year in arrears.

About the Sponsor

Owl Rock was founded by former Wall Street senior executives, including Doug Ostrover, Marc Lipschultz and Craig Packer from Blackstone Group LP, KKR & Co. and Goldman Sachs Group Inc. respectively. It has grown rapidly since it began managing money in 2016 to have over $7 billion in assets under management. As of June 30, 2018, employees of Owl Rock have committed $124 million across all of its investments. In partnership with financial sponsors and private companies, Owl Rock can lead or anchor highly customized financings across a variety of industries and provides investors with access to alternative investment strategies that offer the potential to generate income and attractive risk-adjusted returns.

Sources: SEC, Blue Vault, Owl Rock

Learn more about Owl Rock Capital Partners on the Blue Vault Sponsor Focus page