Overlooking the Risk-Return Relationship in Listed vs. Nontraded REITs

June 16, 2022 | James Sprow | Blue Vault

Investors that choose to diversify their portfolios with alternatives such as commercial real estate have to pay attention to more than just historical returns. Constructing an efficient portfolio involves consideration of expected returns, of course, but a thoughtful investor also weighs the risks in terms of volatility and liquidity. When evaluating the attractiveness of REITs, the correlation of returns offered by commercial real estate investments with the other assets in a portfolio are a key consideration. Investors looking for income also value dividend yields. An advisor making recommendations would certainly evaluate performance on several dimensions: expected return, volatility, correlation with the balance of the portfolio, dividend yield, and liquidity.

A June 13, 2022, article by Robert Stepleman, was entitled “The Rational Investor: Don’t let current volatility scare you into non-traded REITs.1” In that article the author cites some interesting data regarding the returns experienced by exchange-traded REITs and non-traded REITs. By citing recent returns to the exchange-traded REITs in 2021 as well as studies done by Morningstar and Green Street over 20-year and 8-year periods, respectively, he makes the case that exchange-traded REITs have outperformed nontraded REITs by substantial margins.

At Blue Vault we track the total returns to the shareholders of all continuously-offered nontraded REIT programs and have reported that data since January 2020 for the programs that are available to new investors. While the nontraded REIT shares are not listed on an exchange, they do report monthly adjustments to their net asset values per share (NAVs) and their distribution yields. Taken together, these changes in NAV and distributions paid make up the total returns to shareholders. It’s important to note that monthly changes in NAVs are determined by independent third-party valuation firms, using the methods that appraisers use for commercial property appraisals, including discounting cash flows using market-determined discount rates and cap rate assumptions for each of the REIT’s property investments.

It’s interesting to note that the monthly NAVs reported by the nontraded REITs contrast with the estimated NAVs per share that analysts report for the listed REITs. Citing a recent report from S&P Global, the median premiums and discounts for the listed REITs ranged from a premium of 26.6% for the two farmland REITs to a discount of 38.6% for two regional mall REITS. For all 145 US REITs in the report, “Publicly listed U.S. equity REITs traded at a median 14.7% discount to their consensus S&P Capital IQ net asset value per-share estimates as of May-end, a further decline from the 8.9% discount at which they traded as of April-end.2” In layman’s terms, listed REITs can trade at considerably less than analysts estimate their “fair values” to be. And these discounts can change drastically over just a month’s time. This raises the question: “Is it reasonable that the properties owned by listed REITs could drop in value by five percent in a month’s time?” Or is it more reasonable to conclude that the listed REIT market can behave irrationally at times when it comes to valuing the commercial real estate portfolios held by exchange traded REITs?

Returning to Stepleman’s article, the Morningstar calculation of returns to listed REITs over a 20-year period found that they outperformed nontraded REITs by 50%. Using NAREIT’s All REIT Index for listed REIT returns from 2002 thru 2021, Blue Vault estimates the average annual return to listed REITs was roughly 10.8%. Using Morningstar’s estimate of the outperformance compared to nontraded REITs, the nontraded REITs would have an implied 20-year average annual return of 7.2%. He cites a Green Street study that found an 8-year return to listed REITs outperforming nontraded REITs by 30%. Referring again to NAREIT’s All REIT Index, Blue Vault estimates the listed REITs averaged approximately 8.9% annual returns, implying a comparative return to the nontraded REITs of 6.8%. Without knowing the data used in these comparisons and the actual sample periods, we can’t dispute these findings. The data used in the two studies are not specified in the Stepleman article.

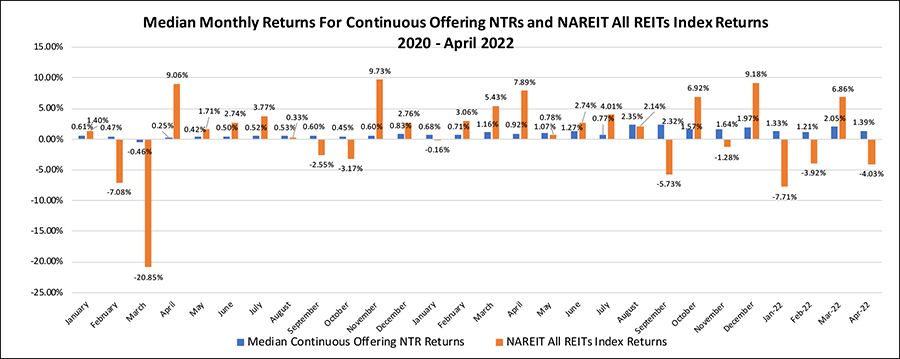

In the following chart, we show the median total returns to the continuously offered nontraded REITs and the monthly total returns to the NAREIT All REIT Index. One thing stands out: volatility in monthly returns is strikingly different between the two series. And, it’s also important to remember that the All REIT Index returns are an average across hundreds of exchange traded REITs. This means that the returns to individual listed REITs or even a particular asset class among those REITs has even greater volatility, as averages tend to smooth out the monthly variations in returns.

The chart above shows the wide variation in monthly returns to listed REITs. But what about the daily variation? Can REIT investors ignore the daily returns and keep their eyes on the horizon? Human nature may not allow investors to do that in many cases. Interestingly, as this author sat down to consider the Stepleman article, the NAREIT website showed the following figures, that show the price changes for traded REITs one recent morning:

Any investor in listed REITs would find this mid-day report of their returns very disturbing. It takes a lot of self-discipline as an investor to ignore this kind of variation in your investment values. Granted, the NAVs of the continuously offered nontraded REITs are not values that can be reflecting daily variations in commercial real estate values, but they do represent what the nontraded REITs offer to pay to shareholders who wish to redeem their shares. The redemption values offer some assurance that shareholders are not going to be subject to wild swings in values. Every continuously offered nontraded REIT has redemptions in their prospectuses that are tied to their monthly NAVs.

Stepleman makes a statement regarding redemptions of shares by the continuously offered nontraded REITs. For example, he says “Many allow annual early redemptions of a limited percentage of outstanding shares, about 3% to 5%.” This is not an accurate statement, given the prospectuses of the continuously offered nontraded REITs that state the limits on redemptions are 2% of NAV per prior month and 5% of NAV per prior quarter. He also states that nontraded REITs have a “defined end-date, perhaps 10 years.” This is false, as the continuously offered nontraded REITs currently raising capital are perpetual and none state a planned closing date in their prospectuses. Also, using the Blackstone REIT as an example, the “lock-up period” of one year has only a 2% discount from NAV for those early redemptions. He also states that there is a 10% discount for early redemptions which is not accurate.

Stepleman alludes to the reduction in management fees, including initial underwriting and organizational costs that have come down for the nontraded REITs. But he states that these costs “are still higher and more difficult to understand than [exchange-traded REITs] EREITs’.” Blue Vault has done reports quarterly for the nontraded REITs and those reports show all fees and expenses related to the offerings and the asset management fees charged by the advisors. If anything, investors have more transparency with regard to fees and expenses of nontraded REITs than they may see with exchange-traded REITs.

In conclusion, considering the full spectrum of potential investor concerns, there are more factors to consider than average rates of return for listed REITs and nontraded REITs. Volatility is important. Correlations with the balance of an investor’s portfolio are important. Liquidity features are important. Fees and expenses are important. Blue Vault reports monthly and quarterly on the NAVs of the continuously offered nontraded REITs and using those reports and the data we report an investor can get a much more complete picture of the potential returns and risks of these alternative investments.

Sources:

1) The Rational Investor: Don’t let current volatility scare you into non-traded REITs, Robert Stepleman, Herald Tribune, June 13, 2022

2) NAV Monitor: US equity REITs trade at 14.7% discount to NAV at May-end, S&P Capital IQ, June 3, 2022

Not a Blue Vault subscriber? Subscribe today.