November 2021 Nontraded REIT Sales Up 5.2% from October

December 13, 2021 | James Sprow | Blue Vault

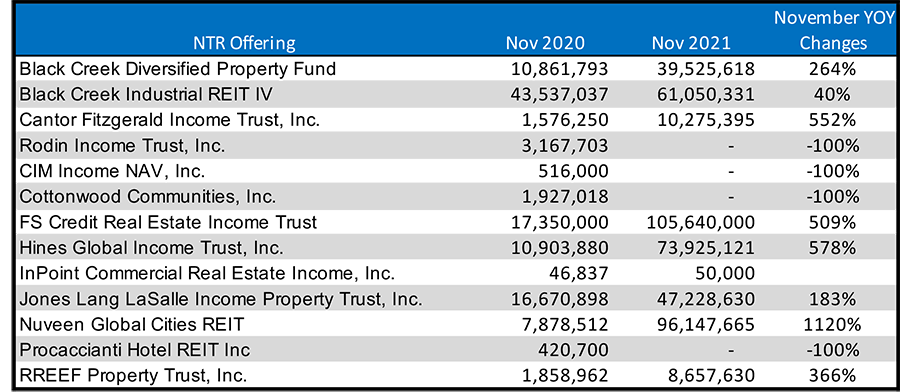

Blue Vault received November sales totals for nine nontraded REIT program offerings as of December 9, 2021. Sales reported by those nine NTRs totaled $442.5 million, up 5.2% from $420.8 million in October, but up 279% Y-O-Y from the $116.7 million in sales in November 2020. Among reporting nontraded REITs, FS Credit Real Estate Income Trust led the group with $105.6 million in sales, up 54.9% from the sales by the REIT in October. Nuveen Global Cities REIT reported $96.1 million in November sales, up 19.5% from $80.4 million in October. Hines Global Income Trust was next with $73.9 million compared to $66.5 million in October. Black Creek Industrial REIT IV was fourth with $61.1 million, up 73.8% from $35.1 million in October.

Y-O-Y NTR Capital Raise Comparisons

Sales by Blackstone REIT and Starwood REIT Estimated

Although neither Blackstone REIT nor Starwood REIT are reporting monthly sales to Blue Vault, 424b3 SEC filings by these two continuously offered nontraded REITs give data on the status of their public offerings. Using these data, we can estimate their common stock issuances both from the offerings and DRIP reinvestments. By far the largest nontraded REIT is Blackstone, raising a large majority of all capital being raised in the sector. The charts below show the shares issued in their offering. Because the capital raised is reported only in billions, the monthly totals are inexact, but the overall magnitude of their capital raise is evident. For the period 10/15/21 through 11/12/21, Blackstone REIT raised approximately $1.9 billion through the issuance of over 164 million shares. For the same period, Starwood REIT issued over 24 million shares, raising approximately $610 million.

Nontraded BDC Sales

Only one nontraded BDC was raising funds and reported to Blue Vault in November 2021. Owl Rock Core Income Corp. had $281.2 million in equity capital raised in November, down 14% from the October total of $328.2 million, but up 110% from the August total of $133.6 million. Blackstone’s nontraded BDC was also raising capital but did not report its sales to Blue Vault.

Quarterly Nontraded BDC Capital Raise

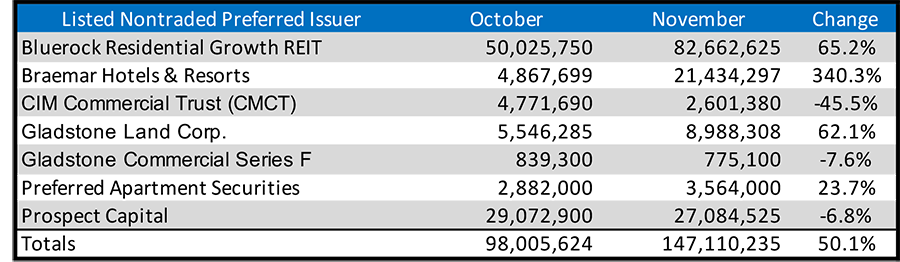

Listed Offerings with Nontraded Preferred Stock Issuances

Blue Vault has received sales reports from seven listed offerings that issue nontraded preferred stock. Leading the group was Bluerock Residential Growth REIT with $82.7 million in preferred stock issuances, up 65% from the October total. Prospect Capital issued $27.1 million in nontraded preferred stock, down 6.8% from the October total. For all seven listed offerings that issued nontraded preferred, the total was $147.1 million, up 50.1% from the October total of $98.0 million.

Interval Fund and Closed-End Fund Capital Raise Reported to Blue Vault Increase 4.2%

Eleven interval funds reported their November 2021 capital raise to Blue Vault, totaling $510.7 million, up 4.2% from the $490.1 million reported by the same 11 funds for October. The highest total was reported by Bluerock Capital Markets for their Total Income+ Real Estate Fund at $188.2 million, up 5.9% from $177.5 million in October. Next was Griffin Institutional Access Real Estate Fund with $116.3 million in November, up 10.2% from $105.5 million in October.

Source: SEC, Blue Vault