Karl Angelo Vidal, Chris Hudgins | S&P Global Market Intelligence

The manageable debt and quality assets are cushioning listed office real estate investment trusts in the US against the elevated interest rate environment.

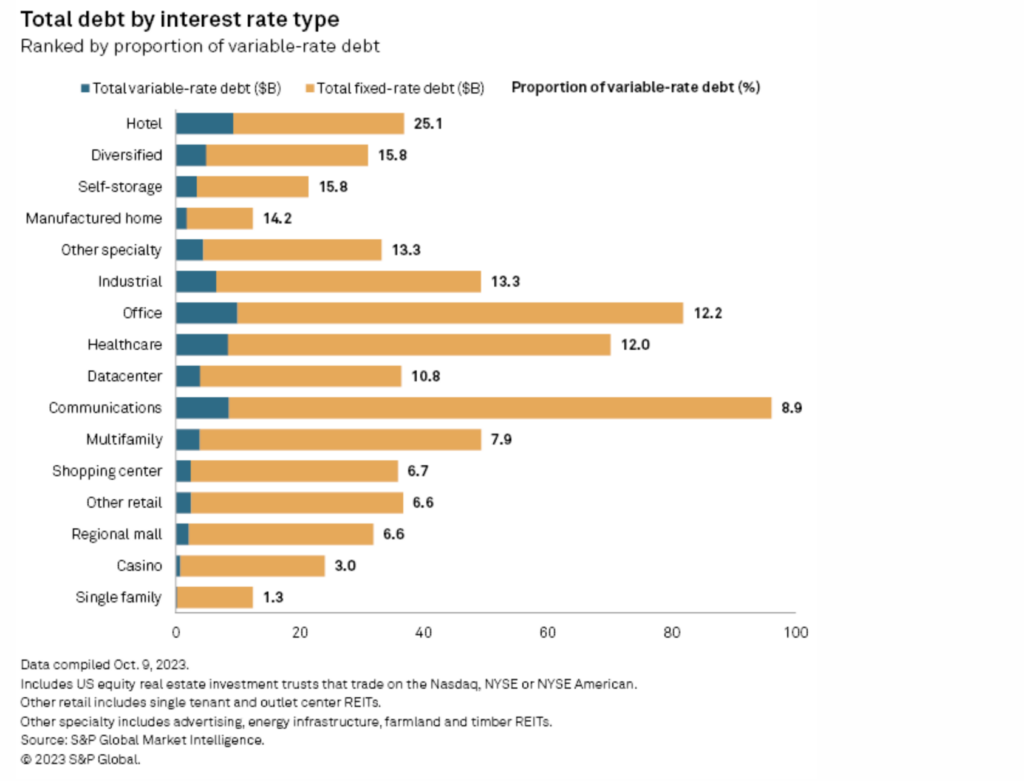

Public office REITs had total debt of $81.69 billion as of the end of the second quarter, 87.8% of which has a fixed rate, according to S&P Global Market Intelligence data.

Close to half of the total office REIT debt has a maturity of 2028 or later, while only 14.2% will mature by the end of 2024.