KBS REIT II Sells San Jose, CA Building, Announces $0.40 Liquidating Distribution

December 28, 2020 | James Sprow | Blue Vault

KBS Real Estate Investment Trust II Inc. sold a three-story, 96,502-square-foot building in San Jose, Calif., for $50.5 million.

Thor Equities LLC acquired the building at 350 Holger Way within the eight-building, 415,492-square-foot District 237 office/research and development complex. The building is fully leased through 2027.

Greenberg Traurig LLP represented KBS as legal counsel in the sale.

Separately, KBS said its board authorized a third liquidating distribution of 40 cents per common share, to be paid Dec. 30 to stockholders of record as of Dec. 24 close.

The company will fund the distribution from proceeds from the sales of 350 Holger Way and 250 Holger Way, which closed in September.

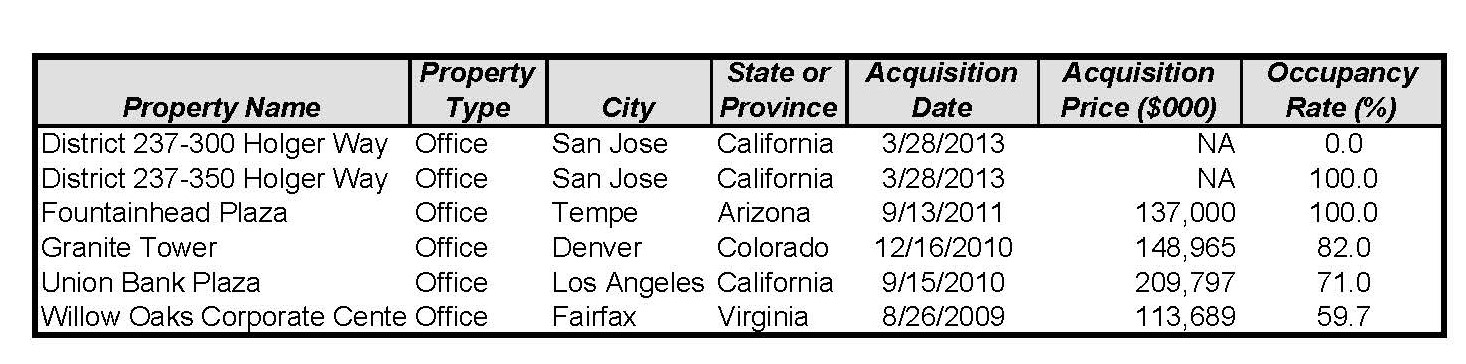

According to S&P Global Market Intelligence, the REIT still owns properties within the District 237-350 Holger Way portfolio, as well as office properties in Tempe, AZ, Denver, CO, Los Angeles, CA, and Fairfax, VA. Those four properties were acquired from 2009 through 2011 for a total acquisition price of $609 million.