June 2023 Reported Nontraded REIT Sales Down 11.3% from May 2023

July 27, 2023 | James Sprow | Blue Vault

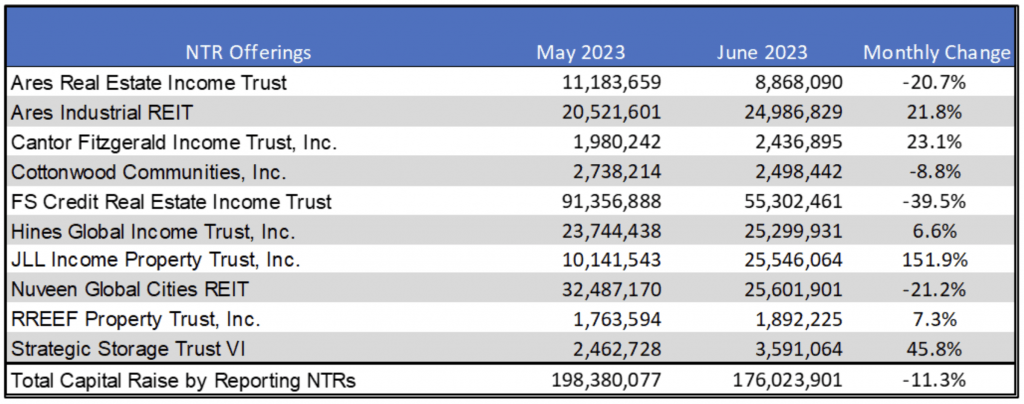

Blue Vault received June 2023 sales totals for ten nontraded REIT program offerings as of July 19, 2023. Sales reported by those ten NTRs totaled $176.0 million, down 11.3% from $198.4 million in May for the same ten NTRs, and down 72% Y-O-Y from the $630.7 million in sales in June 2022. FS Credit Real Estate Income Trust led the reporting REITs once again with $55.3 million in June, down 58% from $133.2 million in May. Next was Nuveen Global Cities REIT with $25.6 million, down 21% from the REIT’s May sales of $32.5 million. JLL Income Property Trust’s sales increased 152% from $10.1 million in May to $25.5 million in June. Hines Global Income Trust posted sales of $25.3 million in June, up 6.6% from the REIT’s May total of $23.7 million. Ares Industrial REIT raised $25.0 million, up 21.8% from $20.5 million in May. Strategic Storage Trust VI posted a 45.8% increase in sales for June at $3.6 million. (Ares Real Estate Income Trust June sales exclude $85.4 million in UPREIT sales).

Table I

All capital raise figures for these nontraded REITs include DRIP proceeds.

Chart I shows monthly sales for reporting nontraded REITs since June 2021. The June 2023 total is the lowest monthly total since February 2021 when industry sales for reporting REITs were just $123 million.

Chart I: Reported NTR Sales

Sales in the chart do not include capital raised by Apollo Realty Income Solutions, Blackstone REIT, Starwood REIT, Brookfield REIT, and Invesco REIT. Those five REITs raised an estimated $6.094 billion in Q1 2023 and raised capital with equity sales in Q2 2023 but did not report to Blue Vault. Blackstone REIT raised $5.78 billion (including DRIP) in Q1 2023, followed by Starwood REIT with $200.0 million, Apollo Realty Income Solutions with $60.3 million, Brookfield REIT with $38.3 million and Invesco REIT with $12.8 million.

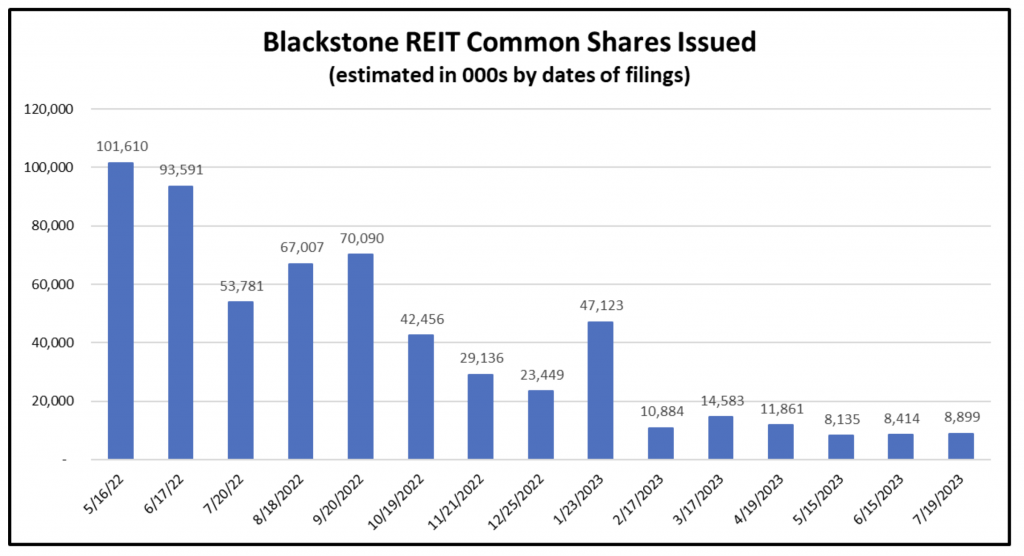

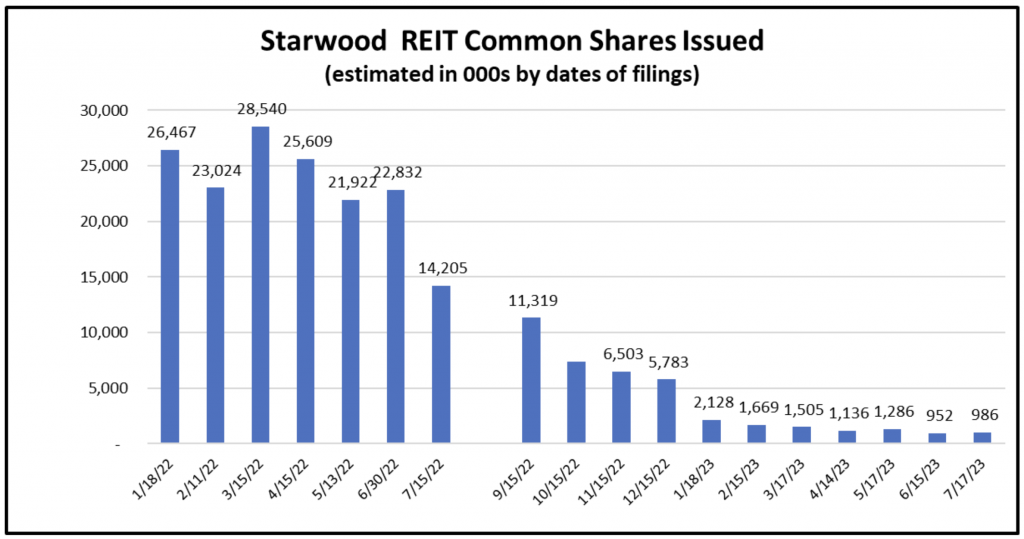

Estimated Common Stock Issuances by Blackstone REIT and Starwood REIT

Using the monthly 424b3 filings by Blackstone REIT and Starwood REIT, we can plot the estimated number of common shares issued by the two nontraded REITs. The data bridge two offerings for each REIT, so some discontinuity in the monthly totals may show up in the series. Blackstone REIT appears to have issued the most shares over the time period in March 2022, while Starwood REIT issued its highest total in December 2021. Both REITs reported significant drops in common share issuances over the last eight to twelve months. Both REITs have also been subject to a large volume of redemptions requests, reaching their monthly limits of 2% of total NAV in every month since November 2022 and pro-rating the number of share redemption requests fulfilled in November 2022 thru June 2023. Shareholders who wished to redeem shares in June 2023 will have to re-submit their redemption requests each month as the pro-rated fulfillments reach monthly limits. Blackstone REIT received redemption requests totaling $3.8 billion in June, down 29% from the January 2023 peak. Starwood REIT’s repurchase requests in June were approximately 43% lower than their peak in January 2023.

Chart II: Blackstone REIT Stock Issuances

Chart III: Starwood REIT Stock Issuances

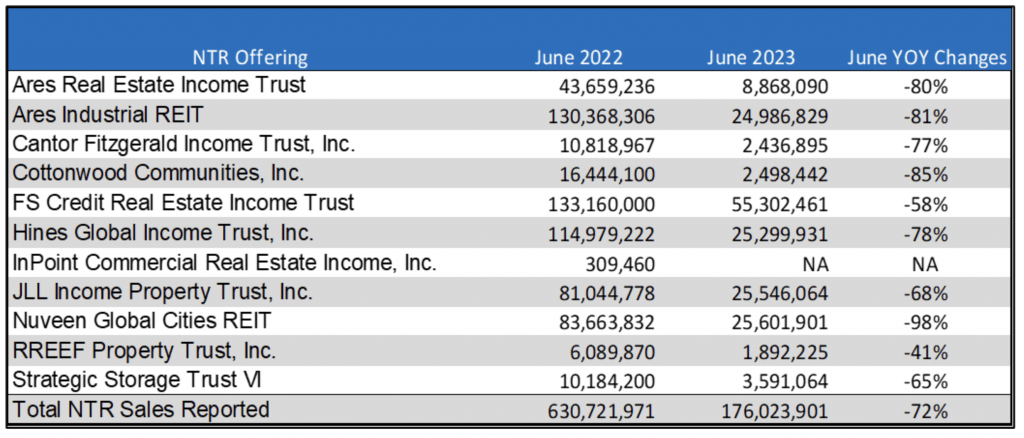

Y-O-Y NTR Capital Raise Comparisons

Year-over-year comparisons show capital raised by same-store reporting nontraded REITs was down 72%.

Table II

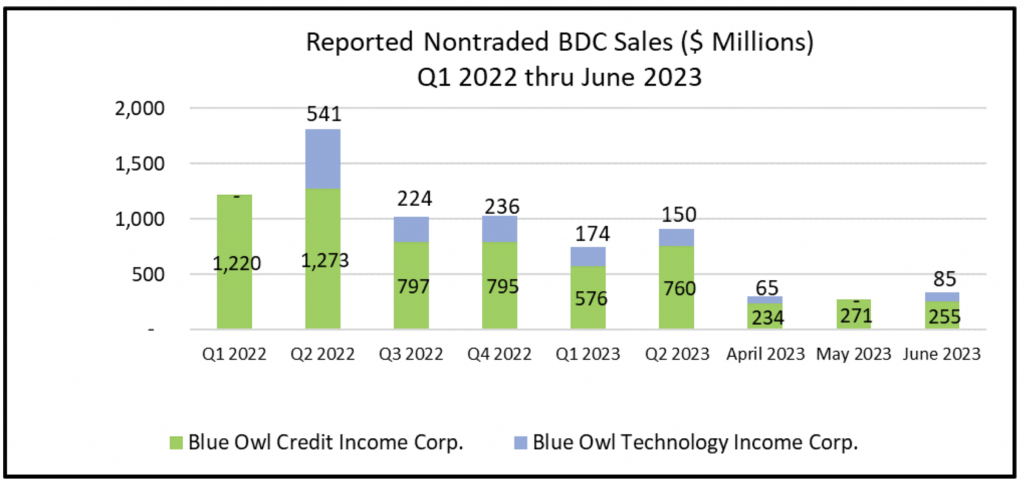

Nontraded BDC Capital Raise thru June 2023

Only two nontraded BDCs was raising funds and reported to Blue Vault for June 2023. Blue Owl Capital Inc. (formerly Owl Rock Capital Advisors) reported $255.5 million in equity capital raised by Blue Owl Credit Income Corp. in June 2023, down 5.6% from the May total of $270.5. Blue Owl Technology Income Corp. reported sales of $85.0 million. Blackstone’s nontraded BDC, Blackstone Private Credit Fund, was also raising capital but did not report its sales to Blue Vault. Quarterly capital raise for the two Blue Owl nontraded BDCs since Q1 2022 are shown below thru June 2023 totals.

Chart IV: Nontraded BDC Sales

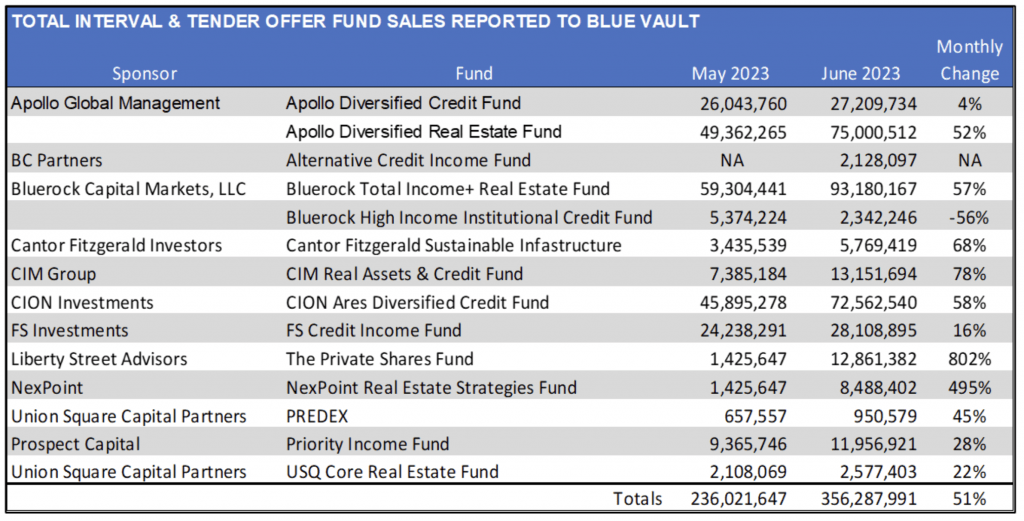

Interval and Tender Offer Fund Sales Reported to Blue Vault for June

A total of fourteen Interval Funds and Tender Offer Funds reported their capital raise for June 2023 to Blue Vault. Bluerock Total Income+ Real Estate Fund once again led the group, raising $93.2 million, up 57% from the $59.3 million total for May. The 14 funds that reported had total capital raise of $356.3 million, up 51% from the $236.0 million raised by 14 funds in May 2023. The total raised by these funds exceeded the $176.0 million raised by the reporting NTRs in June.

Table III

Listed REITs and BDCs with Nontraded Preferred Stock Issuances

Blue Vault has received sales reports from four listed REITs and a listed BDC that issued nontraded preferred stock in June 2023. Leading the group was the listed REIT Creative Media & Community Trust Corp with $11.57 million in preferred stock issuances, up 169% from the $4.3 million May total. Ashford Hospitality Trust issued $10.6 million, down 18% from $12.9 million in May. For all five listed funds that issued nontraded preferred and reported to Blue Vault, the total was $24.9 million, down 57% from the May total of $57.6 million reported by the same funds.

Table IV

Private Placement Sales Reported to Blue Vault

Twenty asset managers reported their private placement totals for June 2023 to Blue Vault. We do not identify individual asset managers and their total sales, but for the industry as a whole we have monthly totals and can report the trends in private placement fundraising. June’s total for the reporting firms was $814.2 million, up dramatically from the $670.4 million reported for May. The total was the highest since February 2023’s $868.9 million for the same sample of firms.

Chart V

Sources: SEC, Individual Program Sponsors, Blue Vault