Industrial Properties Leading Type Owned by Nontraded REITs

February 10, 2022 | James Sprow | Blue Vault

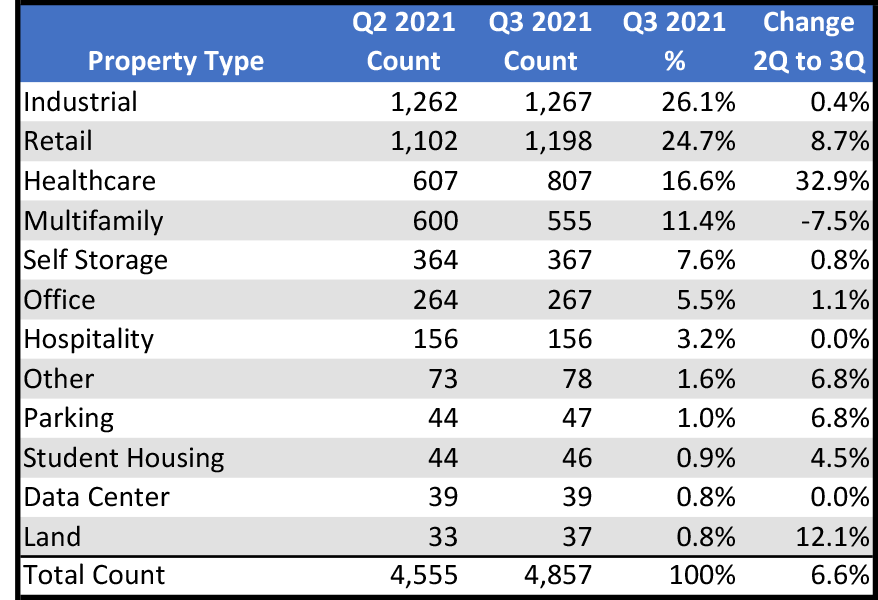

The data available on the properties owned by nontraded REITs reveals that the Industrial classification leads all others, with 26.1% of the properties compared to 24.7% classified as Retail and 16.6% classified as Healthcare. The actual property counts can be understated, as, for example, 10 of the Industrial properties are listed as “Portfolios.” About 35 of the properties classified as Healthcare are also listed as “Portfolios.” The data available to Blue Vault shows a total of 4,857 properties owned by nontraded REITs.

Table I Properties Owned by Nontraded REITs

One event that influenced the count of Multifamily properties was the merger of Steadfast Apartment REIT with Independence Realty Trust (“IRT”), a listed REIT. That merger reduced the Multifamily property count by 73. Blackstone REIT listed 279 Multifamily properties in Q2 2021 and 288 Multifamily properties in Q3 2021, six of which are listed as “Portfolios.”

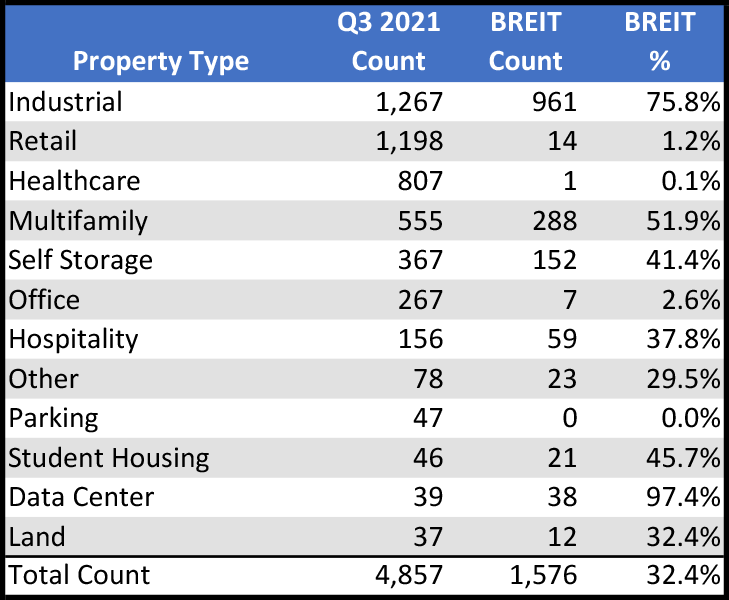

Blackstone REIT is listed as the owner of over 32.4% of the properties owned by nontraded REITs. The REIT owns 75.8% of the Industrial properties and 38 out of 39 of the Data Center properties owned by NTRs as of Q3 2021. Blackstone REIT owns more Self Storage properties (152) than SmartStop Self Storage REIT (146) which is a nontraded REIT focusing solely on such properties.

Table II Properties Owned by Blackstone Real Estate Income Trust, Inc.

Blackstone REIT owned 1,249 properties as of Q2 2021 and has increased that count to 1,576 as of Q3 2021, an increase of 26.2% over one quarter.

Sources: S&P Global Market Intelligence, Blue Vault