Gladstone Land Corporation (Nasdaq:LAND) (“Gladstone Land” or the “Company”) announced today that it will have the first closing for the continuous offering of its 5.00% Series E Cumulative Redeemable Preferred Stock (the “Series E Preferred Stock”) on January 19, 2023. The Company filed the prospectus supplement for the offering on November 9, 2022. In anticipation of the first closing, the board of directors declared the following cash distributions for each of January, February and March 2023 for the Series E Preferred Stock.

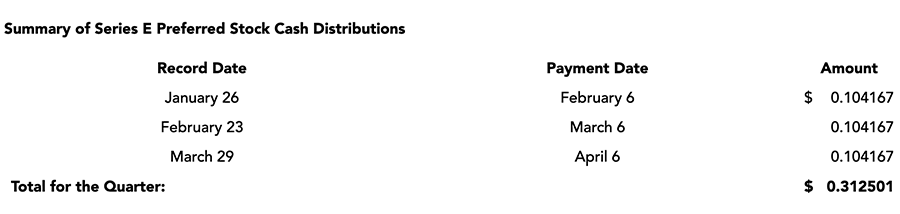

Series E Preferred Stock (Unlisted): $0.104167 per share of Series E Preferred Stock for each of January, February and March 2023, payable per the table below:

“We are excited by the early positive reception of our Series E Preferred Stock offering in the independent broker-dealer and registered investment advisor channels with the first closing occurring within two months of filing the prospectus supplement.” said David Gladstone, President of Gladstone Land.

The Company expects that the offering of its Series E Preferred Stock will terminate on the date that is the earlier of either December 31, 2025 (unless earlier terminated or extended by the Company’s board of directors) or the date on which all 8,000,000 shares offered in the Series E Preferred Stock offering are sold (the “Termination Date”). The Company intends to use the net proceeds from the Series E Preferred Stock to fund property acquisitions in accordance with its investment objectives, pay related property acquisition expenses, and for other general corporate purposes. There is currently no public market for shares of Series E Preferred Stock. The Company intends to apply to list the Series E Preferred Stock on Nasdaq or another national securities exchange within one calendar year of the Termination Date, however, there can be no assurance that a listing will be achieved in such timeframe, or at all.

Gladstone Securities, LLC, a FINRA-member broker-dealer, is acting as dealer manager on this offering.

Investors are advised to carefully consider the investment objectives, risks, charges and expenses of the Company before investing. The prospectus supplement dated November 9, 2022 and the accompanying prospectus dated April 1, 2020, which have been filed with the SEC, contain this and other information about the Company and the Series E Preferred Stock offering and should be read carefully by prospective investors before investing.

The Series E Preferred Stock offering is being conducted as a public offering under the Company’s effective shelf registration statement filed on Form S-3 with the U.S. Securities and Exchange Commission (the “SEC”) (File No. 333-236943). The Company has filed a registration statement (including a prospectus) and a prospectus supplement with the SEC for the Series E Preferred Stock offering. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents that the Company has filed with the SEC for more complete information about the Company and the Series E Preferred Stock offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Gladstone Securities, the Company’s dealer manager for the Series E Preferred Stock offering, will arrange to send you the prospectus and prospectus supplement if you request it by calling toll-free at (833) 849-5993 or email info@gladstonesecurities.com.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

About Gladstone Land:

Gladstone Land is a publicly-traded real estate investment trust that invests in farmland located in major agricultural markets in the U.S., which it leases to farmers. The Company, which reports the aggregate fair value of its farmland holdings on a quarterly basis, currently owns 169 farms, comprised of over 115,000 acres in 15 different states and 45,000 acre-feet of banked water in California, valued at a total of approximately $1.6 billion. Additional information can be found at www.GladstoneLand.com.

For further information: Gladstone Land Corporation, (703) 287-5893

For stockholder information on Gladstone Land, call (703) 287-5893. For Investor Relations inquiries related to any of the monthly dividend-paying Gladstone funds, please visit www.GladstoneCompanies.com.