Gladstone Land Corporation (Nasdaq:LAND) (“Gladstone Land” or the “Company”) announced today that its board of directors declared the following cash distributions for each of January, February and March 2023.

Monthly Cash Distributions:

Common Stock: $0.0459 per share of common stock (an increase from the monthly dividend declared and paid the prior quarter) for each of January, February and March 2023, payable per the table below:

The Company has paid 119 consecutive monthly cash distributions on its common stock since its initial public offering in January 2013 and has increased its common stock distributions 29 times over the prior 32 quarters. The Company offers a dividend reinvestment plan (the “DRIP”) to its common stockholders. For more information regarding the DRIP, please visit www.GladstoneLand.com.

Series B Preferred Stock (Nasdaq:LANDO): $0.125 per share of Series B Preferred Stock for each of January, February and March 2023, payable per the table below:

The Company has not skipped, reduced, or deferred a monthly Series B Preferred Stock distribution to date.

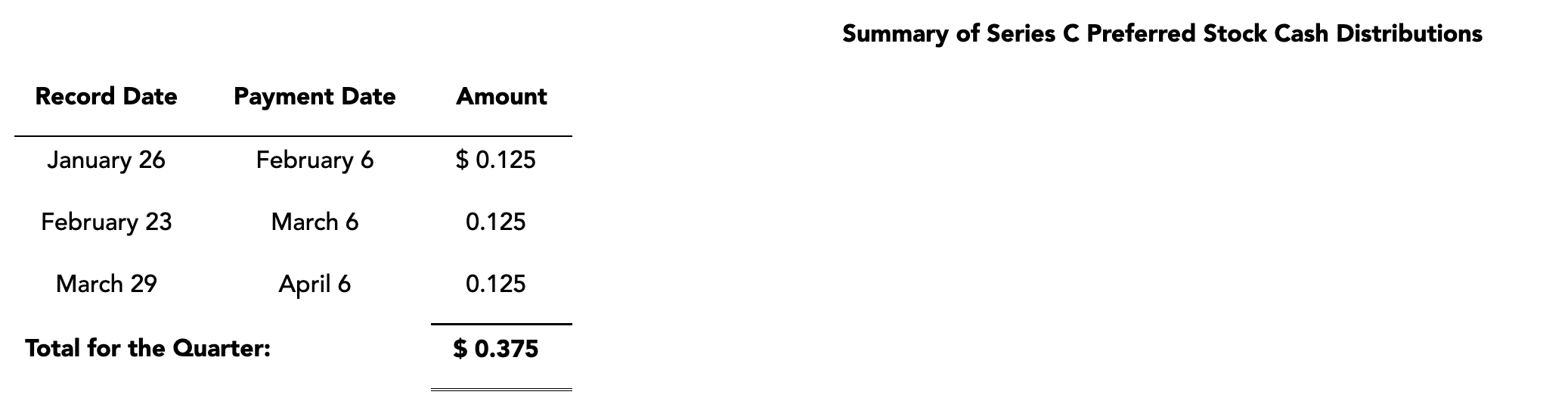

Series C Preferred Stock (Unlisted): $0.125 per share of Series C Preferred Stock for each of January, February and March 2023, payable per the table below:

The Company has not skipped, reduced, or deferred a monthly Series C Preferred Stock distribution to date.

Series D Preferred Stock (Nasdaq: LANDM): $0.104167 per share of Series D Preferred Stock for each of January, February and March 2023, payable per the table below:

The Company has not skipped, reduced, or deferred a monthly Series D Preferred Stock distribution to date.

Earnings Announcement:

The Company also announced today that it plans to report earnings for its fourth quarter ended December 31, 2022, after the stock market closes on Tuesday, February 21, 2023. The Company will hold a conference call on Wednesday, February 22, 2023, at 8:30 a.m. EST to discuss its earnings results. Please call (877) 407-9046 to join the conference call. An operator will monitor the call and set a queue for questions.

A conference call replay will be available after the call and will be accessible through March 1, 2023. To hear the replay, please dial (877) 660-6853 and use playback conference number 13734663.

The live audio broadcast of the Company’s conference call will also be available online at www.GladstoneLand.com.

About Gladstone Land:

Gladstone Land is a publicly-traded real estate investment trust that invests in farmland located in major agricultural markets in the U.S., which it leases to farmers. The Company, which reports the aggregate fair value of its farmland holdings on a quarterly basis, currently owns 169 farms, comprised of over 115,000 acres in 15 different states and 45,000 acre-feet of banked water in California, valued at a total of approximately $1.6 billion. Additional information can be found at www.GladstoneLand.com.

For stockholder information on Gladstone Land, call (703) 287-5893. For Investor Relations inquiries related to any of the monthly dividend-paying Gladstone funds, please visit www.GladstoneCompanies.com.

For further information: Gladstone Land Corporation, (703) 287-5893