Gladstone Commercial Corporation (Nasdaq:GOOD) (the “Company”) announced today that its board of directors declared cash distributions for the months of January, February and March 2023 and also announced its plan to report earnings for the fourth quarter ended December 31, 2022.

In an effort to increase retained capital in anticipation of further economic headwinds, the board of directors has taken what it believes is the prudent path and reduced the run rate on its monthly dividend (from $0.1254 to $0.10). In addition, and in support of the capital preservation effort, the Company’s investment adviser has agreed to amend the current Advisory Agreement to waive the applicable incentive fee for the quarters ending March 31, 2023 and June 30, 2023. Buzz Cooper, the Company’s President, stated, “We believe that the dividend cut, along with the temporary incentive fee waiver, will help the Company to maintain a strong balance sheet in 2023.”

Cash Distributions:

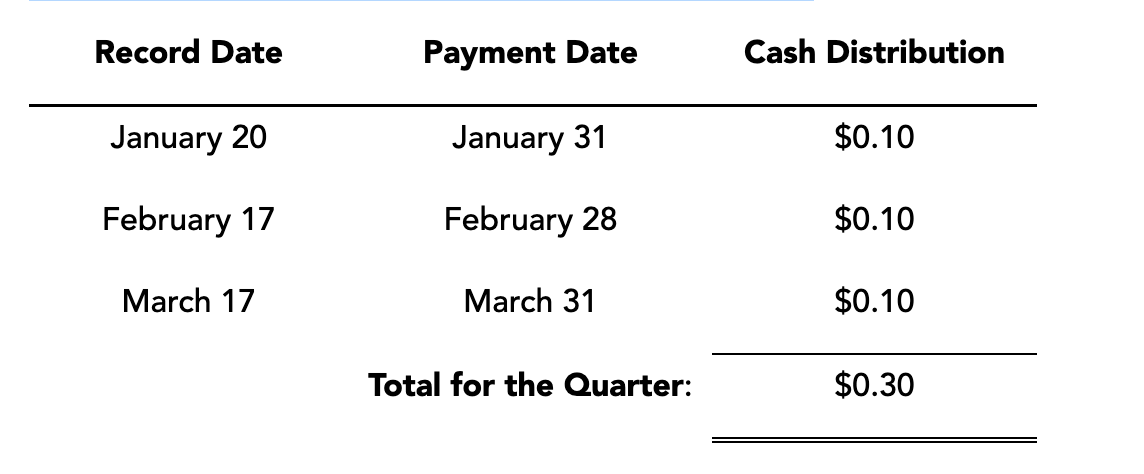

Common Stock: $0.10 cash distribution per common share for each of January, February and March 2023, payable per Table 1 below. The Company has paid 216 consecutive monthly cash distributions on its common stock. Prior to paying distributions on a monthly basis, the Company paid five consecutive quarterly cash distributions.

Table 1: Summary of common stock cash distributions:

Senior Common Stock: $0.0875 cash distribution per share of the Company’s senior common stock (“Senior Common”) for each of January, February and March 2023, payable per Table 2 below. The Company has paid 153 consecutive monthly cash distributions on its Senior Common. The Company has never skipped, reduced or deferred a monthly Senior Common distribution.

Table 2: Summary of Senior Common cash distributions:

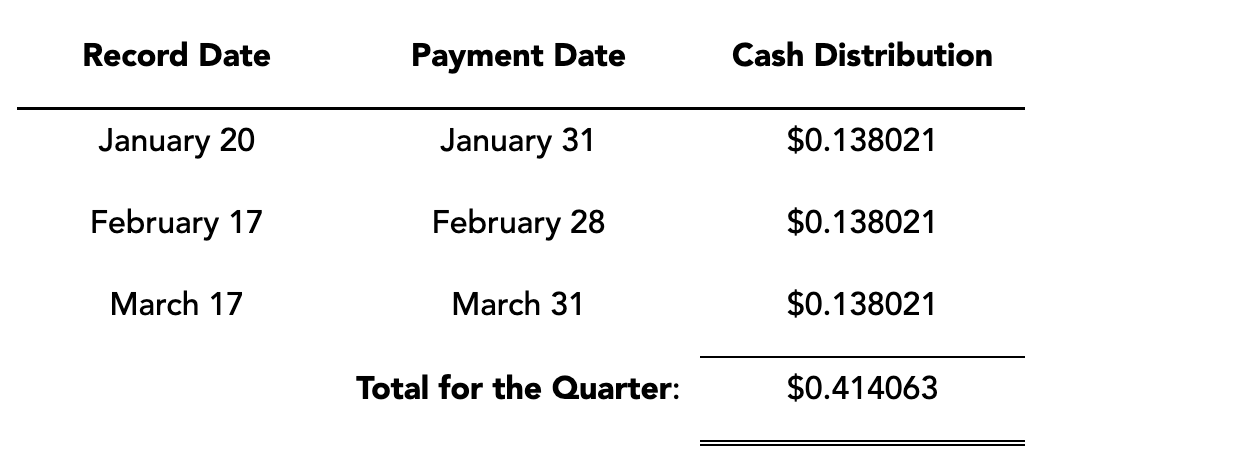

Series E Preferred Stock: $0.138021 cash distribution per share of the Company’s 6.625% Series E Preferred Stock (“Series E Preferred Stock”) for each of January, February and March 2023, payable per Table 3 below. The Series E Preferred Stock trades on Nasdaq under the symbol “GOODN.” The Company has paid 30 consecutive monthly cash distributions on its Series E Preferred Stock. The Company has never skipped, reduced or deferred a monthly Series E Preferred Stock distribution.

Table 3: Summary of Series E Preferred Stock cash distributions:

Series F Preferred Stock: $0.125 cash distribution per share of the Company’s 6.0% Series F Preferred Stock (“Series F Preferred Stock”) for each of January, February and March 2023, payable per Table 4 below. The Series F Preferred Stock is not listed on a national securities exchange. The Company has never skipped, reduced or deferred a monthly Series F Preferred Stock distribution.

Table 4: Summary of Series F Preferred Stock cash distributions:

The Company offers a dividend reinvestment plan (the “DRIP”) to its common stockholders and Series F Preferred stockholders. For more information regarding the DRIP, please visit www.gladstonecommercial.com.

Series G Preferred Stock: $0.125 cash distribution per share of the Company’s 6.00% Series G Preferred Stock (“Series G Preferred Stock”) for each of January, February and March 2023, payable per Table 5 below. The Series G Preferred Stock trades on Nasdaq under the symbol “GOODO.” The Company has never skipped, reduced or deferred a monthly Series G Preferred Stock distribution.

Table 5: Summary of Series G Preferred Stock cash distributions:

Earnings Announcement:

The Company also announced today that it plans to report earnings for the fourth quarter ended December 31, 2022, after the stock market closes on Wednesday, February 22, 2023. The Company will hold a conference call Thursday, February 23, 2023 at 8:30 a.m. ET to discuss its earnings results. Please call (877) 407-9045 to enter the conference call. An operator will monitor the call and set a queue for questions.

A conference call replay will be available after the call and will be accessible through March 2, 2023. To hear the replay, please dial (877) 660-6853 and use playback conference number 13734662.

The live audio broadcast of the Company’s conference call will be available online at www.gladstonecommercial.com.

If you have questions prior to or following the earnings release you may e-mail them to info@gladstonecompanies.com.

Gladstone Commercial Corporation is a real estate investment trust (“REIT”) focused on acquiring, owning and operating net leased industrial and office properties across the United States. As of September 30, 2022, Gladstone Commercial’s real estate portfolio consisted of 137 properties located in 27 states, totaling approximately 17.2 million square feet. Additional information can be found at www.gladstonecommercial.com.

Investor Relations Inquiries: Please visit www.gladstonecommercial.com or (703) 287-5893.