Continuously Offered Nontraded REITs Maintain Positive Returns in May

June 30, 2022 | James Sprow | Blue Vault

Eleven of the thirteen continuously offered non traded REIT programs reported increases in their net asset values per share in May 2022, with the median increase at 0.33% and the average increase 0.55%. The greatest increase in an NAV per share from April 30 to May 31 was reported by Cottonwood Communities, with Class A shares increasing the NAV by 2.74% from $20.08 to $20.63.

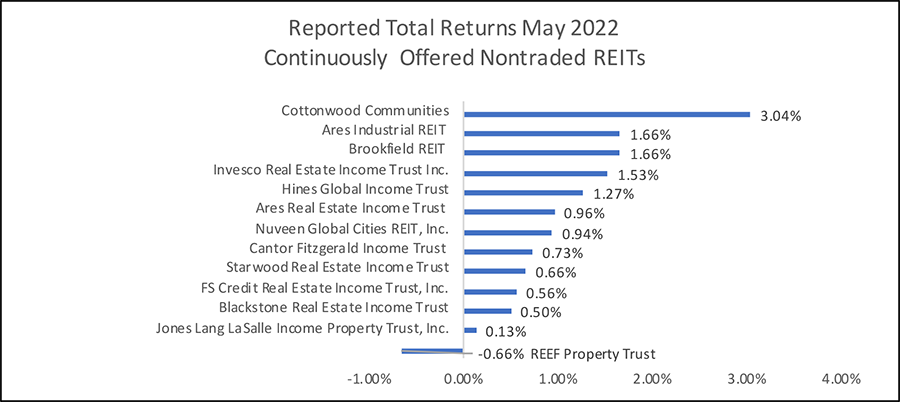

Increase in net asset values contributed to total returns which had a median total return of 0.94% in may for the thirteen NTRs. Only one continuously offered NTR had a negative total return in May. RREEF Property Trust reported a negative total return for the month of 0.66%. Cottonwood Communities, a nontraded REIT that had interests in 33 multifamily properties as of March 31, 2022, reported a total return of 3.04% for the month of May.

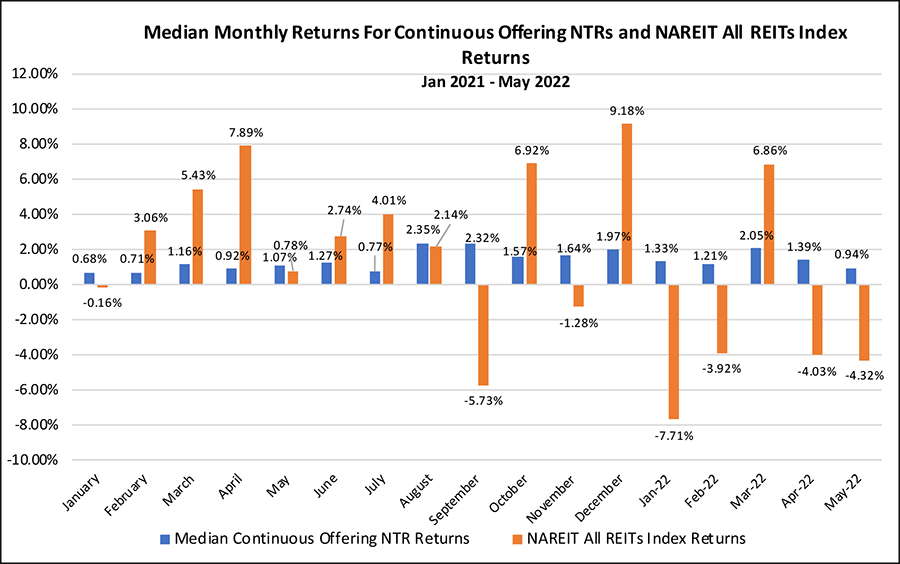

When compared to the monthly total returns to listed REITs in the NAREIT All REITs Index, the continuously offered nontraded REIT programs showed remarkably less month-to-month volatility in their median returns. The NAREIT All REITs Index had seven months out of 17 with negative returns from January 2021 through May 2022, while the median returns to the continuously offered nontraded REITs did not have any months with a negative median return. Of the 204 monthly observations posted by the nontraded REITs from January 2021 through May 2022, there was only one negative total return.

There is usually a 15 to 20-day delay from the end of each month until the nontraded REIT programs post their monthly total return numbers for the prior month. This month had a longer delay for one of the NTRs.

Sources: Blue Vault, Individual NTR Websites