As Markets Waver, Alternatives Hit Their Stride

July 20, 2022 | Ali Hibbs | WealthManagement.com

Advisor demand for alternative investments is growing, according to a new Cerulli study, with exposures to intermittent liquidity products increasing sharply in 2021.

A new report from Boston-based financial markets researcher Cerulli Associates found that allocations to certain alternative investment products ticked up sharply this year and that alternative strategies remain top of mind for more advisors as equity and bond exposures are buffeted by inflation, rising interest rates and geopolitical turmoil.

Advisor respondents said they allocated an average of 14.5% to alternative investments in 2022, with plans to increase that allocation to 17.5% over two years. This is up from 10.5% in 2021, but Cerulli researchers noted that the pool of respondents was likely skewed in both instances toward advisors who already invest in alternatives and that the actual allocation to commodities and other alternatives is currently closer to 10% across the industry. Even so, the research still indicates significant growth following years of relative inertia.

“Cerulli sees the current market environment as a Goldilocks moment for alternative investment distribution,” the report said. “Demand for income, inflation protection, enhanced returns, and volatility dampening is coinciding with an increase in supply of products that can help lead to these respective outcomes.”

Produced in partnership with Blue Vault, an alternatives education resource for advisors, the alternatives-focused investment study was based on a survey of 100 advisors—primarily at independent broker/dealers—and interviews with industry professionals.

Virag Shah, portfolio strategist at Van Leeuwen and Co., a $317 million registered investment advisor based in Princeton, N.J., said his firm increased alternative allocations earlier this year. “We added commodities,” he said. “Not just energy or oil, but more broad, general commodities such as metals and agriculture. We added those to the portfolio mix along with other things that we already had previously.” Shah estimated that, under current market conditions, firms should be allocating at least 15% of their portfolio to alternative strategies to see any meaningful benefits.

The case is “getting stronger and stronger,” he said, to abandon the longstanding 60/40 portfolio allocation standard—one to which Van Leeuwen has never adhered.

Reducing exposure to public markets was advisors’ top reason for using alternative investment products in 2022, cited by 69% of respondents, with volatility dampening and downside risk protection a close second with 66% of advisors. Other reported goals include income generation, portfolio diversification, enhanced returns, inflation hedging, demonstrating their own practice value propositions and responding to client requests.

“Wealth advisors are being reminded that it’s wise to adopt an overall investment strategy of employing broad diversification, which includes market non-correlation strategies,” said Stacy Chitty, managing partner at Blue Vault.

“Advisors are increasingly aware of these product offerings as a wave of both traditional and alternative managers build out capabilities and wholesalers reach out to explain the benefits of the exposures,” according to Cerulli Director Daniil Shapiro, who coauthored the report with Cerulli Analyst Wenyi Wei.

Across investment structures, liquid alternative mutual funds remain the most popular, used by 68% of advisors, followed by nontraded REITs (61%) and liquid alternative ETFs (54%). More than half of responding advisors said that the illiquidity of other alternative products is unsuitable for their clients, while also citing product complexity and high management fees as their top obstacles to investing in alternatives with severely restricted liquidity. But interest in semiliquid options saw a sharp increase in 2021.

“Liquid alternatives will remain a welcoming entry point,” said Shapiro. But, he added, “tremendous opportunity exists for less liquid alternatives.”

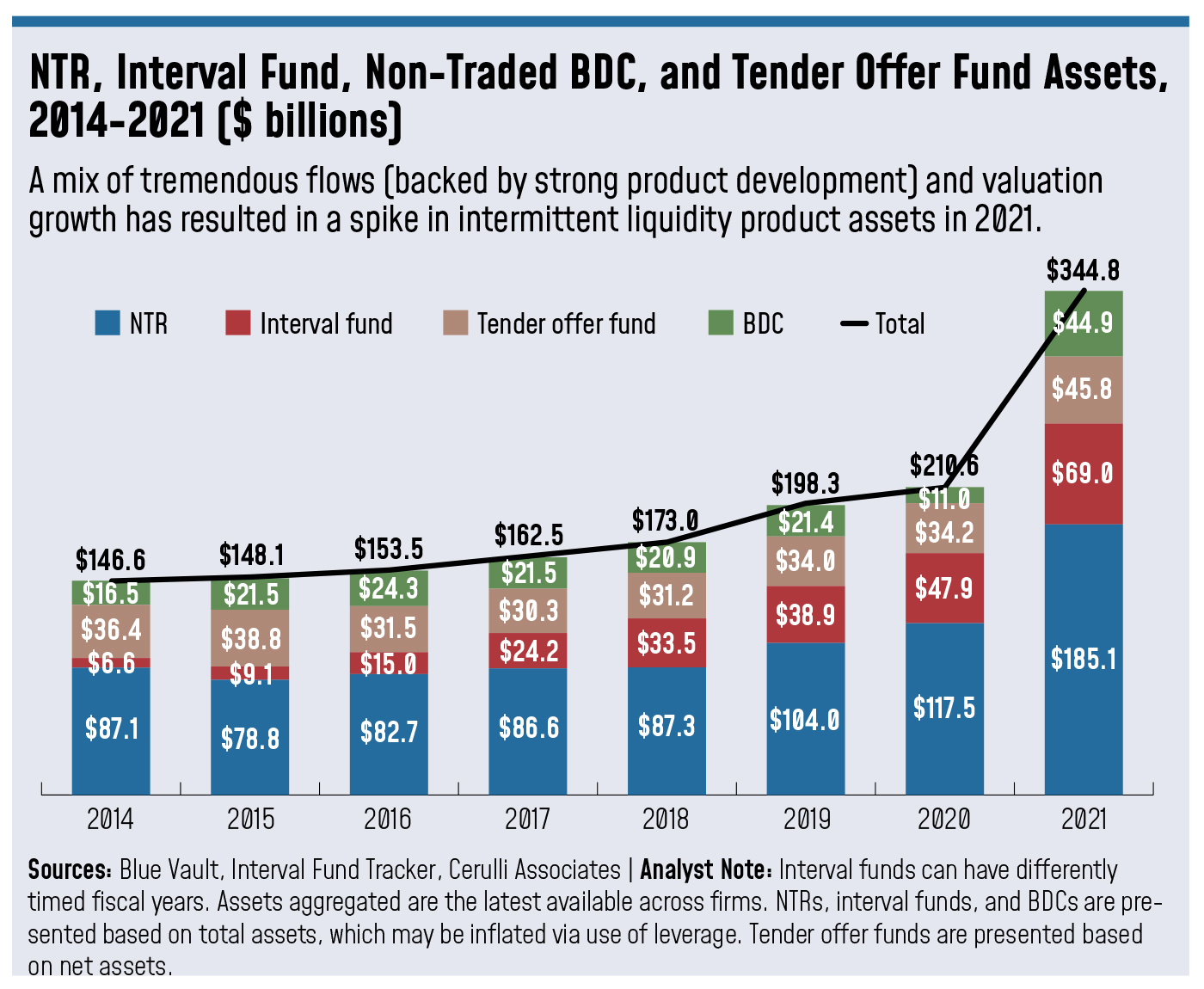

Intermittent liquidity product allocations—to nontraded REITs, interval funds, nontraded business development companies and tender offer fund assets—saw a 63.7% year-over-year increase in 2021, growing from $210.6 billion to $344.8 billion after remaining under $200 billion though the previous decade.

A new generation of intermittent liquidity products is proving more palatable to advisors than an earlier crop that saw temporary growth following the last market crisis, according to the report. This is due to three primary factors: key M&A transactions (such as Franklin Templeton’s acquisitions of Benefit Street Partners and Alcentra and Apollo’s acquisition of Griffin Capital); product developments with improved consistency, performance and fee structures; and changes in the distribution landscape, including the growth of alternative investment platforms such as CAIS and iCapital. Products from reputable asset managers such as Blackstone, KKR and Apollo are also lending to their growing popularity, Cerulli noted.

“Clearly, there is a market opportunity for products that offer something between the long-term lockups of institutionally oriented structures and the daily liquidity of most stock and bond funds,” said Shapiro. “Cerulli believes there is a tremendous opportunity here.”

Van Leeuwen’s Shah agrees that intermittent liquidity products have been underrepresented in the market and are set to see continued growth over the next five years. “A lot of people don’t really know that market that well yet,” he said. “I think there is a lot of growth opportunity available down the road.” He said that he would personally like to see more alternatives provide limited liquidity, outside of the more common real estate vehicles.

While the available intermittent liquidity products have improved and “indeed appear to have hit their stride for investor portfolios,” Cerulli still recommends careful evaluation of all alternative investment opportunities to determine suitability and insists that they not be viewed “as a panacea.”

“Firms looking to allocate more to alternatives will need to be prepared for unique distribution challenges and have specialized staff on hand to understand these products and their fit within portfolios,” said Shapiro.

Get additional insight on the 2022 Cerulli and Blue Vault Alts survey results by joining us for a webinar on 8/17 at 2pm EDT.