James Sprow | Blue Vault

When we examine the success that Blackstone Real Estate Income Trust (“BREIT”) has demonstrated since its inception in 2017, we can attribute a significant portion of that success to the REIT’s building its property portfolio with assets from CRE sectors that have performed better than most. For example, the managers of BREIT, by the end of 2018, had constructed a property portfolio that contained 51% multifamily assets and 37% industrial assets when measured by fair value. Along with just 11% of its portfolio in hospitality and 1% in retail, the REIT was positioned relatively well to outperform other nontraded REIT programs when the pandemic hit.

While the impact of the pandemic that began in Q1 2020 was significant, during 2020 the BREIT raised $8.8 billion in its continuous public offering and moved into asset sectors that would prove to outperform in the ensuing years. The REIT acquired 129 self storage properties, 94 multifamily and 94 industrial properties in 2020, and only six retail and one office property, for a total purchase price of $7.5 billion. The REIT also formed a new joint venture with MGM Growth Properties LLC to acquire 49.9% of the Las Vegas assets of MGM Grand and Mandalay Bay.

Here it is important to point out that a nontraded REIT that focuses primarily on real property investments (BREIT also invested $1.2 billion in real estate debt instruments in 2020 to bring those investments to 11% of total assets), portfolio allocations by CRE sector are only made via property acquisitions and dispositions. A property portfolio can be built by raising equity capital in the public offering, and only to the extent that new capital is being raised can it be invested in properties and sector allocations be adjusted. The flexibility enjoyed by the managers of a nontraded REIT to change portfolio sector allocations is thus very limited. Because Blackstone REIT was so successful in raising massive amounts of capital (30% of all capital raised by nontraded REITs in the history of the industry and 76% of capital raised YTD through Q2 of 2023) the REIT had some ability to change its allocations.

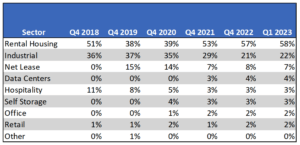

Blackstone REIT’s Property Portfolio Allocations by CRE Sector

In the above table we see that BREIT changed its sector allocations by increasing its focus on rental housing (which includes multifamily, student, affordable and single family rental housing, as well as senior living). These allocations served it well during the pandemic, as multifamily, industrial, data centers and self storage sectors out-performed other asset types.¹

Today, in changing economic environment, most economists expect rental housing and industrial sectors to continue to out-perform in the year ahead. The question we ask is, “If a nontraded REIT can only significantly shift its sector allocations by growing its assets or selling and reinvesting proceeds from sales, how flexible can it be in re-allocating to anticipated out-performing sectors?”

Contrasting the Nontraded REIT Allocation Flexibility to an Interval Fund

Next, we look at a large Interval Fund, Bluerock Total Income+ Real Estate Fund, to see how an Interval Fund has a greater ability to re-allocate its investments to take advantage of changing prospects for CRE sectors. Below is a chart from the fund’s latest annual report that shows the sectors of CRE that are expected to have higher net operating income (NOI) growth over the next five years. This fund had 92% of its AUM invested in the higher growth sectors illustrated in green below.

Source: Green Street, A Great Year Ahead for Commercial Real Estate? March 2023

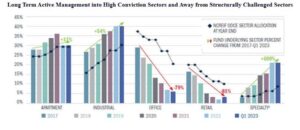

Bluerock Total Income+ Real Estate Fund’s Active Management

Source: Bluerock Total Income+ Real Estate Fund Certified Shareholder Report 3/31/2023

Conclusion

Two points can be made regarding the charts above:

1. Both Blackstone REIT and Bluerock Total Income+ Real Estate Fund have most of their allocations in the high conviction real estate sectors. BREIT had 91% of its portfolio in those sectors as of March 31, 2023, compared to Bluerock Total Income+ RE Fund’s 92% as of the same date.

2. Through its investment allocations to institutional private real estate securities, with $6.77 billion in of its total of $7.20 billion investments, the Interval Fund can be more flexible in its allocations across sectors, and it has been over the past five years. Its investments can be changed at relatively lower transaction costs than those of BREIT, which require more problematic liquidations and reinvestments.

In the last two quarters, Blackstone REIT has had continuing high rates of redemptions, both requested and fulfilled. On a net basis, the REIT has been raising capital at the lowest rates since Q1 2020, the quarter that Covid hit. This raises the question whether BREIT can accomplish significant reallocation across real estate sectors in the future as prospects for different assets change.

Footnotes

1) Through September 2023, listed FTSE Nareit All Equity REITs have a YTD total return of negative 5.61%. Industrial REITs posted total returns averaging +1.73. Residential REITs -1.64, Healthcare +3.14%, Office REITs negative 17.41%, Retail REITs negative 8.93%, Self Storage REITs negative 4.06%, Data Centers +16.39%.

Sources: SEC, NAREIT, Blackstone REIT, Bluerock Total Income+ Real Estate Fund, Blue Vault