REITs Fell Sharply Along with Broader Markets in September

October 7, 2022 | John Barwick | Nareit

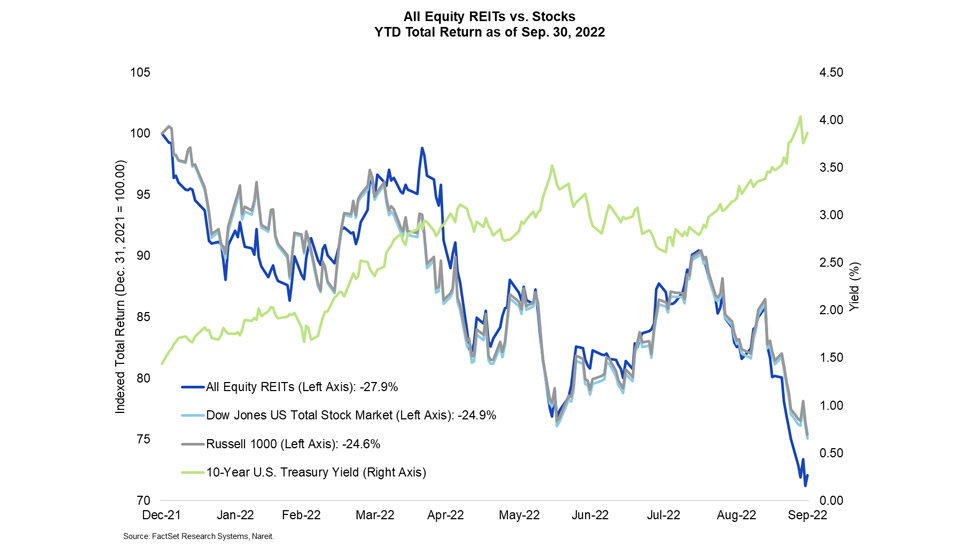

In September, REITs and stocks posted their worst monthly performance since March 2020, as a hawkish Federal Reserve warned that measures to bring inflation under control could bring “some pain” to U.S. financial markets, and Treasury yields continued to rise.

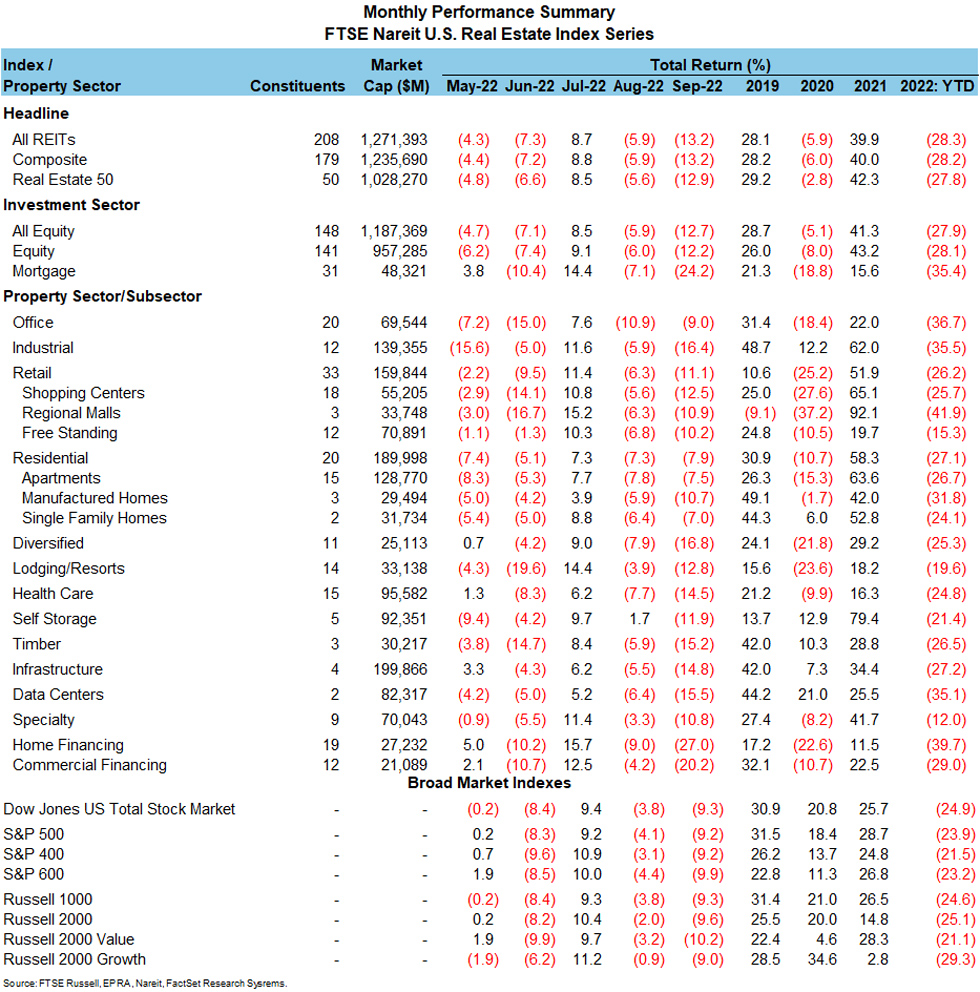

The FTSE Nareit All Equity REITs Index posted a total return of -12.7% and the FTSE Nareit Equity REITs Index fell 12.2% in September. Broader markets also declined, though not as sharply as REITs, as the Dow Jones U.S. Total Stock Market and the Russell 1000 both fell 9.3%. The yield on the 10-year Treasury rose 68 basis points in September to end the month at 3.9%. Rising bond yields have presented a relatively attractive alternative to riskier asset classes, as uncertainty about future earnings and fears of a recession persist.

The year-to-date spread between REIT returns and broad market equities widened in September. Through the end of the month, total returns year-to-date were:

• All Equity REITs: -27.9%

• Russell 1000: -24.6%

• Dow Jones U.S. Total Stock Market: -24.9%

All property sectors posted negative returns in September. Residential, office, and specialty had the best performance, with returns of -7.9%, -9.0%, and -10.8%, respectively.

The diversified sector lagged all others with a total return of -16.8%, followed by industrial at -16.4%, and data centers at -15.5%. Mortgage REITs were also sharply negative in September with a total return of -24.2% for the month, as commercial financing mREITs returned -20.2% and home financing mREITs returned -27.0%.