US Pension Funds Up Real Estate Exposure to Offset Rising Risks

August 18, 2022 | Robert Campbell & Lola Panagos | S&P Global

U.S. public pension funds are increasing their allocations to real estate in an effort to hedge against volatile market conditions, according to an analysis by S&P Global Market Intelligence.

An examination of the latest meeting minutes and investment reports of the 40 largest U.S. public pension schemes in June found increased real estate investment to be the most commonly cited change to investment strategy.

The change is in part triggered by market volatility. Of all alternative assets, real estate is the one most commonly used to hedge against inflation, according to a Preqin survey of institutional investors. Real asset prices tend to rise as inflation increases. It is also the most commonly used asset class for portfolio diversification, with 76% of respondents saying they invested in real estate for this purpose.

Both the California Public Employees’ Retirement System and California State Teachers’ Retirement System increased their target allocations to real assets to roughly 15% from 13% over the past year, according to their November 2021 investment committee reports. The Alaska Retirement Management Board’s also increased its target allocation to the asset class to 14% from 13%, a comparison of its 2021 and 2022 investment reports shows.

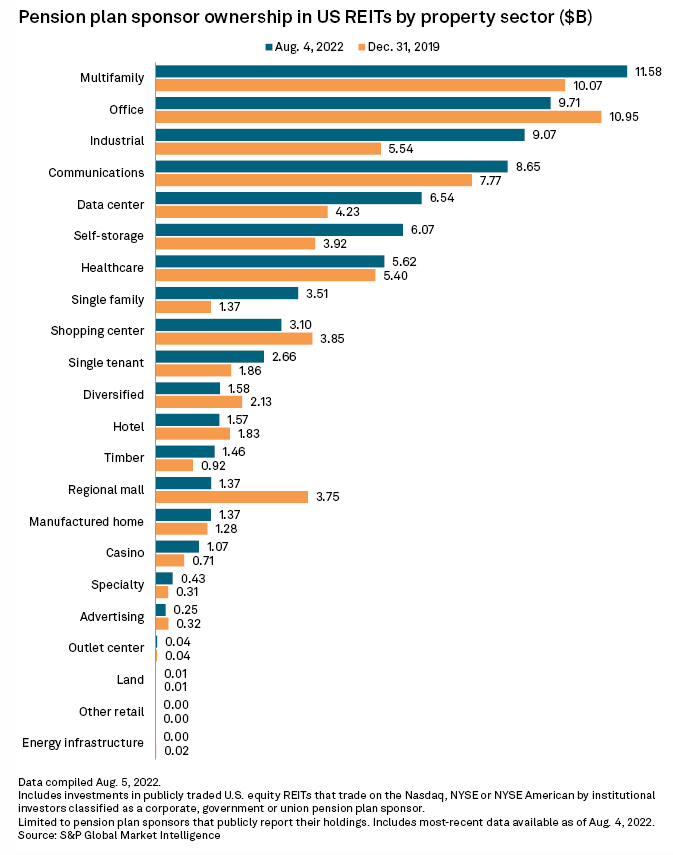

Pension funds are increasingly eyeing the industrial segment of the asset class, which benefitted from the growth in e-commerce during the pandemic as demand for warehouses and last-mile delivery assets increased. Strong demand for these facilities means the sector should reap long-term benefits, according to STRS Ohio’s June 16, 2022 report. Both the State Board of Administration of Floridas June 28, 2022, report and ARM’s Feb. 15, 2022, report also said the industrial sector will compensate for weaker segments of the market such as office and retail.

Among the U.S. public pension funds making real estate investments in recent months are New York State Common Retirement Fund, which made a $500 million commitment to Blackstone Real Estate Partners X (LUX) SCSp on June 30; Baltimore City Fire and Police Employees Retirement System, whose board approved a $20 million investment in IPI Partners Fund III, managed by IPI Partners LLC; and Pennsylvania Public School Employees’ Retirement System, which made a $100 million commitment to EQT Exeter’s EQT Exeter Industrial Core-Plus Fund IV LP.

As pension funds up their allocations to real estate, they are reducing the amount they invest in other asset classes. The Market Intelligence analysis found that board members of Pension Reserves Investment Management Board recommended an increase in their private equity target by 1% and a decrease in their global equities target by 1% as part of the company’s commitment to grow its private market allocation. CalPERS and CalSTRS reduced their global equity allocation to 42% from 50% in November 2021 in response to market volatility.