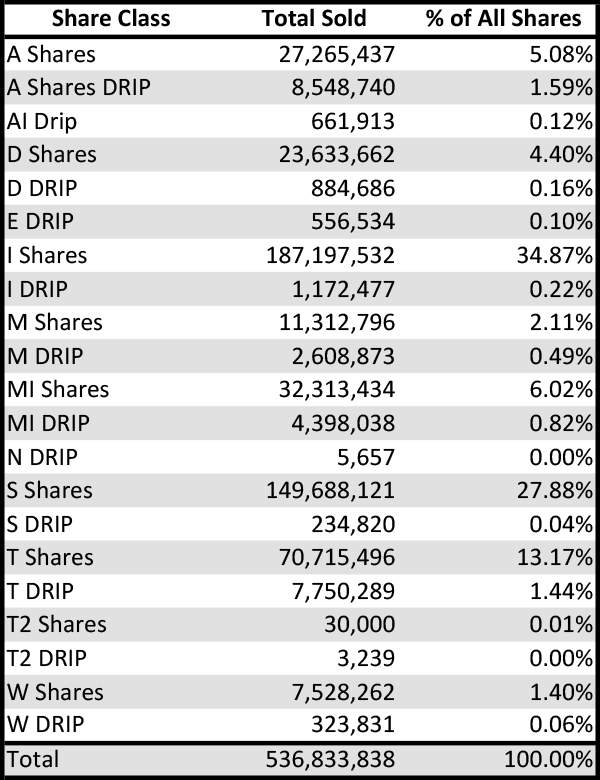

Nontraded REIT Capital Raise by Share Class

February 15, 2022 | James Sprow | Blue Vault

Blue Vault receives capital raise numbers every month from at least 13 nontraded REITs. These REITs use a variety of share classes to raise capital. Each share class has different front end loads and ongoing fees. The most popular share class is Class I which has no selling commission or dealer manager fees, but has a $1,000,000 investment minimum. The second most popular share class in December 2021 sales was Class S which has a selling commission of 3.50% and, in almost all cases, a stockholder servicing fee assessed annually at 0.85% of aggregate NAV. The following table shows the total number of shares sold by reporting NTRs in December 2021. The totals include distributions reinvested in shares (“DRIP”).

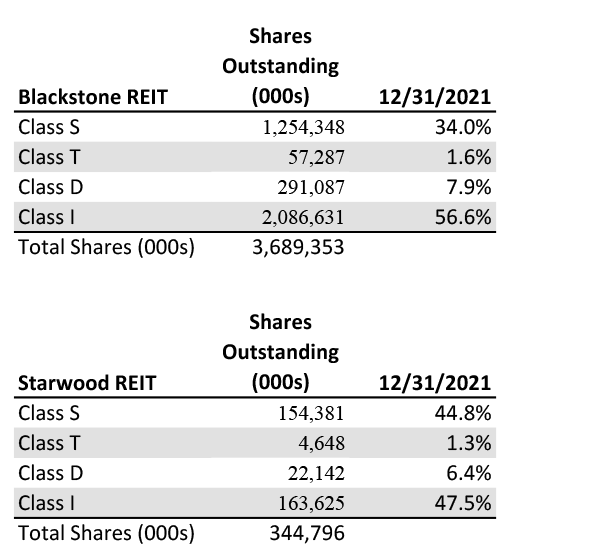

Two nontraded REITs that do not currently report their monthly sales also issue a large portion of their shares in Class I and Class S. Blackstone Real Estate Income Trust has 56.6% of its outstanding shares in Class I and 34.0% in Class S. For Starwood Real Estate Income Trust those percentages are 47.5% and 44.8%, respectively. Both REITs have over 90% of their outstanding shares in the two classes.

Sources: Blue Vault, SEC