James Sprow | Blue Vault |

In this article, we look at the property portfolios and loan portfolios of 12 nontraded REITs to see the types of properties that are in their asset portfolios. By far the largest nontraded REIT in the industry is Blackstone Real Estate Income Trust (“BREIT”) that had over $63.4 billion in total assets as of September 30, 2021. By December 31, 2021, the REIT had a total net asset value of $54.1 billion and investments in real estate totaling $83.5 billion. The REIT generated a 28.7% return for 2021. During 2021 the REIT closed 17 transactions over $500 million in size.

This table shows the 12 nontraded REITs and their total assets as of September 30, 2021. Black Creek Diversified Property Fund was recently acquired by Ares and is now Ares Real Estate Income Trust. On July 15, 2021, Oaktree REIT changed advisers and was renamed Brookfield Real Estate Income Trust. These 12 REITs are currently raising capital. Sixteen REITs raised capital in Q3 2021. There were 37 nontraded REITs that were closed as of September 30, 2021, and did not raise capital in Q3 2021.

Source: Blue Vault

Source: Blue Vault

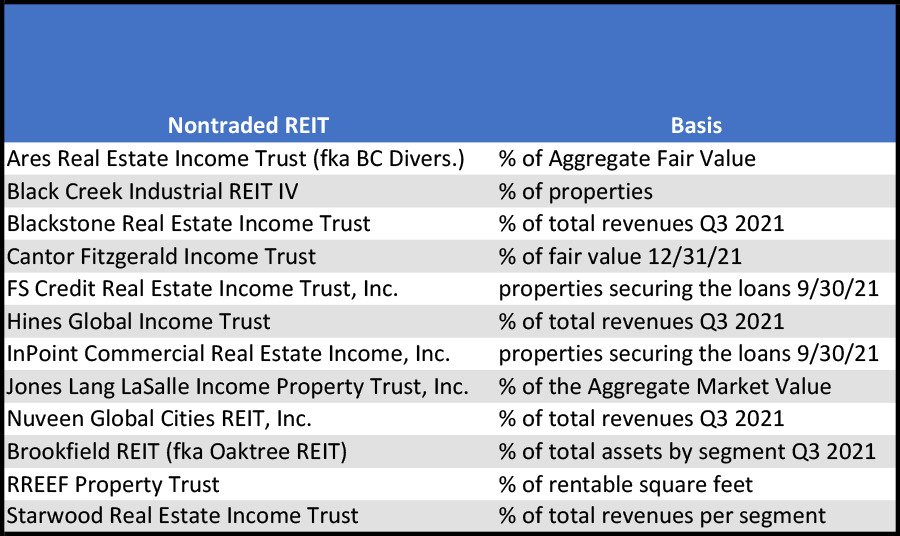

In each 10-Q for the 12 REITs in this article, there are tables giving the composition of the property portfolios. Unfortunately, the REITs break down their property investments in a variety of ways. The table below lists the nontraded REITs the basis they used in their financial statements to calculate the percentage of the portfolio in different asset types. Two of the REITs invest mainly in debt instruments. For those two REITs we will report the percentage of their loan portfolios secured by various property types.

Source: Blue Vault

Source: Blue Vault

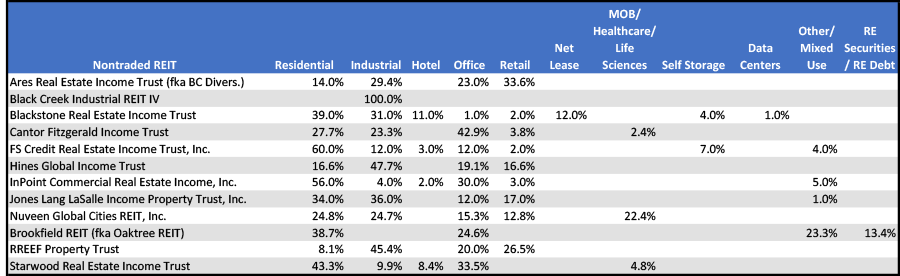

Portfolios by Asset Type

The different property types in the portfolios of the nontraded REITs are broken down into 11 different categories. The Residential category is made up mostly of Multifamily properties, but recently there have been some investments made in single family rentals. The Industrial category is mostly Warehouse/Distribution properties. The Hotel category can be listed as “Hospitality.” The Retail category can include shopping centers and net lease properties, but one REIT (BREIT) breaks out Net Lease as a separate category. The Medical Office, Healthcare and Life Sciences category combines asset totals for each of those three classifications. FS Credit Real Estate Income Trust and InPoint Commercial Real Estate Income invest in loans backed by commercial real estate. For those two REITs we report the types of real estate properties that secure the loans.

By virtue of its size, Blackstone REIT’s investments in Multifamily (Residential) and Industrial mean that the total investments in those categories for the 12 NTRs is the most significant. Blackstone REIT’s relatively insignificant investment in the Office sector is also notable.

Source: Blue Vault

Source: Blue Vault

Sources: SEC, S&P Global Market Intelligence, individual REIT websites, Blue Vault