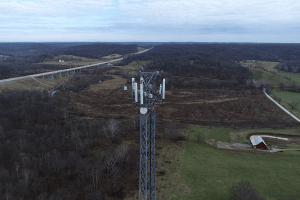

Strategic Wireless Infrastructure Fund Advisors (“Strategic Wireless”), the wireless infrastructure division of Strategic Capital Fund Management, announced today that it completed the acquisition of two cell towers, and other related assets, located south of Indianapolis, Indiana.

The towers are less than five years old and are located along the newly constructed interstate I-69 that connects Indianapolis to Evansville. Multiple top-tier wireless carriers serve as anchor tenants and make up 100% of the rental revenue.

“We believe this acquisition was an excellent opportunity to acquire relatively new towers in a strategic location, with strong existing tenants, while still having capacity to lease additional space to new tenants,” stated Todd Rowley, CEO of Strategic Wireless. “We’re excited to add these assets to our growing portfolio of wireless infrastructure assets.”

About Strategic Capital Fund Management

Headquartered in Greenwich, CT, with regional offices in Costa Mesa, CA, Strategic Capital Fund Management is a privately held, global investment management organization committed to providing access to dynamic asset classes and highly experienced investment professionals to provide clients with attractive risk-adjusted returns. The company is focused on cutting-edge digital economy investments with an emphasis on digital infrastructure, sustainability, and technology-centric sectors.

About Strategic Wireless

Strategic Wireless (a division of Strategic Capital Fund Management) is an investment manager, capital partner and holding company focused on acquiring, developing, and managing telecom infrastructure assets that support broadband connectivity. To help achieve its investment objectives, Strategic Wireless establishes mutually beneficial partnerships with wireless carriers and select independent operators and developers throughout the U.S. The company’s goal is to align interests, provide transparency and offer fair pricing to ensure longstanding working relationships for years to come.

Media Contact:

Robert Bruce

Chief Marketing Officer

949-432-9485