Highlights from the Q4 2020 NTR Review Presentation

May 19, 2021 | James Sprow | Blue Vault

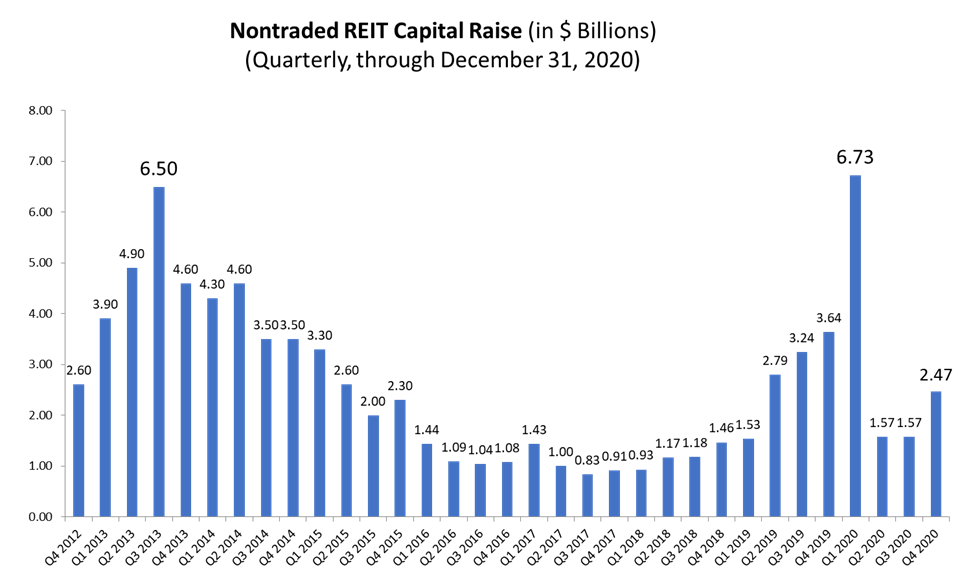

Capital raised by nontraded REITs during Q4 2020 totaled an estimated $2,470.6 million, including DRIP proceeds and including $1,715.2 million in sales by Blackstone REIT. This was 57% greater than the Q3 2020 nontraded REIT total capital raise of $1,574.0 million. There were just 18 nontraded REITs raising capital during Q4 2020, compared to 20 raising capital through public offerings in Q1 2020. With the $6.73 billion raised in Q1 2020, the industry had been on pace to exceed the total of $11.7 billion raised in 2007 until the COVID-19 pandemic appeared to totally depress sales in Q2 2020. In the Q3 2020 Review, we stated that the industry had raised $9.87 billion, placing the 2007 total within reach. With the Q4 2020 total, the industry did exceed the $11.7 billion raised in 2007 with a total of over $12.3 billion.

Capital raised by nontraded REITs during Q4 2020 totaled an estimated $2,470.6 million, including DRIP proceeds and including $1,715.2 million in sales by Blackstone REIT. This was 57% greater than the Q3 2020 nontraded REIT total capital raise of $1,574.0 million. There were just 18 nontraded REITs raising capital during Q4 2020, compared to 20 raising capital through public offerings in Q1 2020. With the $6.73 billion raised in Q1 2020, the industry had been on pace to exceed the total of $11.7 billion raised in 2007 until the COVID-19 pandemic appeared to totally depress sales in Q2 2020. In the Q3 2020 Review, we stated that the industry had raised $9.87 billion, placing the 2007 total within reach. With the Q4 2020 total, the industry did exceed the $11.7 billion raised in 2007 with a total of over $12.3 billion.

Blackstone REIT led the sector with $1.715 billion in capital raise in Q4 2020 for a 69% market share, having raised an estimated total of $21.639 billion since inception. Starwood REIT was next at $309 million for a 12.5% share. Black Creek Industrial REIT IV was third with $135.9 million raised in their offering and a 5.5% market share. Jones Lang LaSalle Income Property Trust ranked fourth at $90.0 million, followed by Hines Global Income Trust at $56.9 million. Combined, all 13 other NTRs raising capital totaled just $164.0 million, 6.6% of the industry total.

Altogether, the active nontraded REITs in Q4 2020 had raised a total of $74.1 billion in their public offerings, including DRIP proceeds. This does not include DRIP proceeds after the offerings closed. The continuously offered REITs with daily, monthly or quarterly NAVs have dominated the industry since Blackstone, Starwood, Nuveen, Oaktree, FS Credit, Cantor Fitzgerald, Hines Global Income, and Black Creek Industrial REIT IV programs were introduced in 2016 through 2018. Those programs joined Black Creek Diversified Property Fund, CIM Income NAV, RREEF Property Trust and Jones Lang LaSalle Income Property Fund as continuously offered products with improved liquidity and frequent NAV revisions.

There were no full-cycle events in Q4 2020. However, there were two mergers of nontraded REITs completed in the quarter. In October, Pacific Oak Strategic Opportunity REITs I and II merged. In December, Cole Credit Property Trust V and Cole Office & Industrial REIT II merged with CIM Real Estate Finance Trust. Neither merger constituted a full-cycle liquidity event as they both involved shares for shares in the surviving REITs. The CIM Real Estate Finance Trust acquisitions in this report include those assets acquired through the merger.

On August 18, 2020, New York City REIT, Inc. listed on the NYSE (Ticker “NYC”) and had a closing price that day of $17.60 per share. This REIT will not have a full-liquidity event until the final tranche of shares convert to exchange-listed shares in August 2021.

Distribution yields for the 18 open nontraded REIT programs in Q4 2020 had a median value of 4.75%, with only two NTRs having suspended their distributions during the year.

Among the closed nontraded REIT programs, the 16 REITs that were paying distributions had a median rate of 3.97% based upon their original offering prices, but 17 REITs had suspended their distributions as of December 31, 2020.

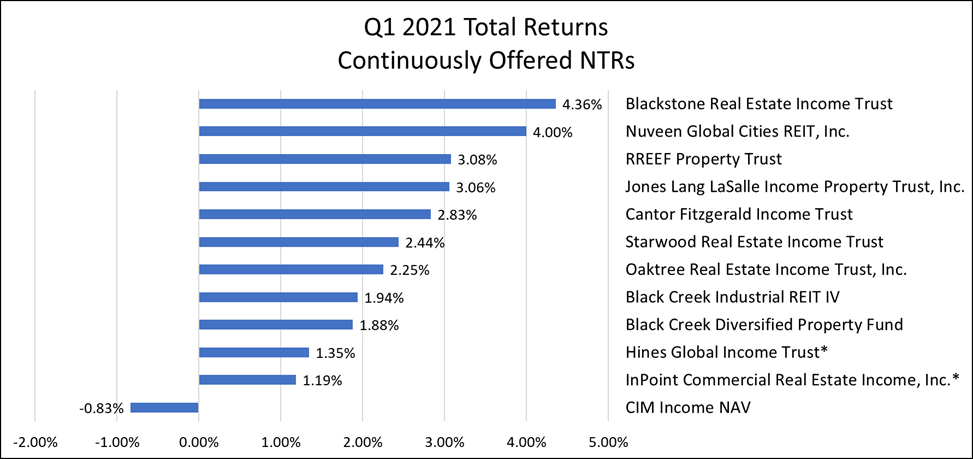

Because the continuously offered nontraded REITs report total returns to shareholders on a monthly or quarterly basis, we were able to report those results for both 2020 and for the first quarter of 2021. Oaktree Real Estate Income Trust led the group with a total return to shareholders in 2020 of 9.95% followed by Blackstone REIT with a total return of 6.92%. The median total return for the group in 2020 was 4.98%. In the first quarter of 2021, all but one continuously offered REIT had positive total returns, led by Blackstone REIT at 4.36% and with a median total return for the group at 2.35%.

One of the selling points for continuously offered nontraded REITs is the lower volatility of the products’ returns when compared to publicly listed REITs. This is illustrated in the median monthly returns for the REITs over the past 15 months as illustrated below. In only one month was the median return for the group in negative territory.

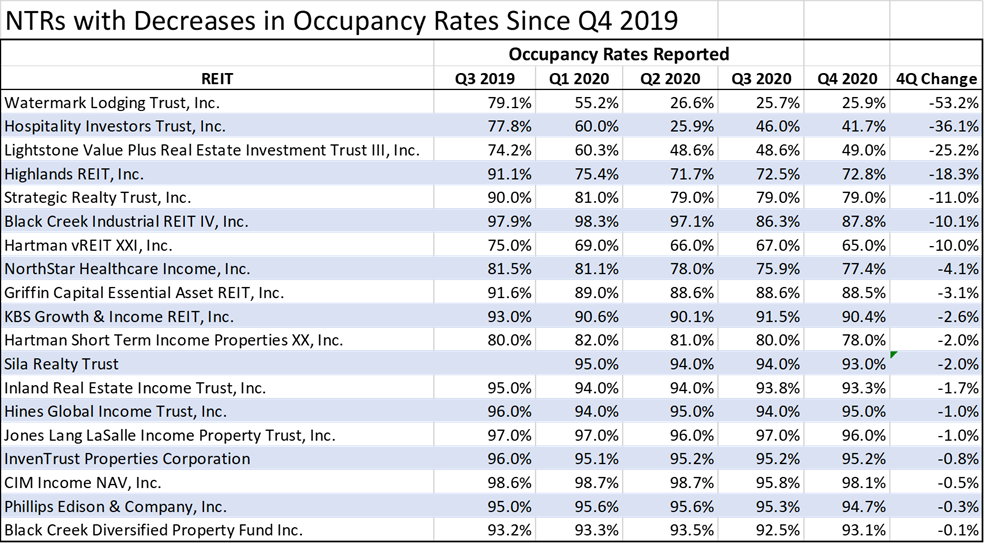

The impacts of the COVID-19 pandemic on the nontraded REITs sector is perhaps best illustrated by the changes in occupancy rates across the portfolios of the REITs. In the table below, the impact upon those REITs with hospitality asset concentrations is clear. The three REITs with the largest drops in occupancy are those with hotel portfolios. Only five REITs had increases in their portfolio occupancies (SmartStop Self Storage REIT (+11.4%), Steadfast Apartment REIT (+2.1%), RREEF Property Trust (+0.8%), Corporate Property Associates 18 – Global (+0.7%) and Griffin-American Healthcare REIT IV (+0.3%).

Source: Blue Vault Partners